How to Print and File Tax Form 1098-E, Student Loan Interest Statement

Ez1099 software makes it easy to paper print, pdf print, file and efile tax form 1098s and 1099s for businesses and accountants

If you have not set up an account and recipients to prepare to 1098-E form, you can click here to see

How to add a new account

How to add a new recipient

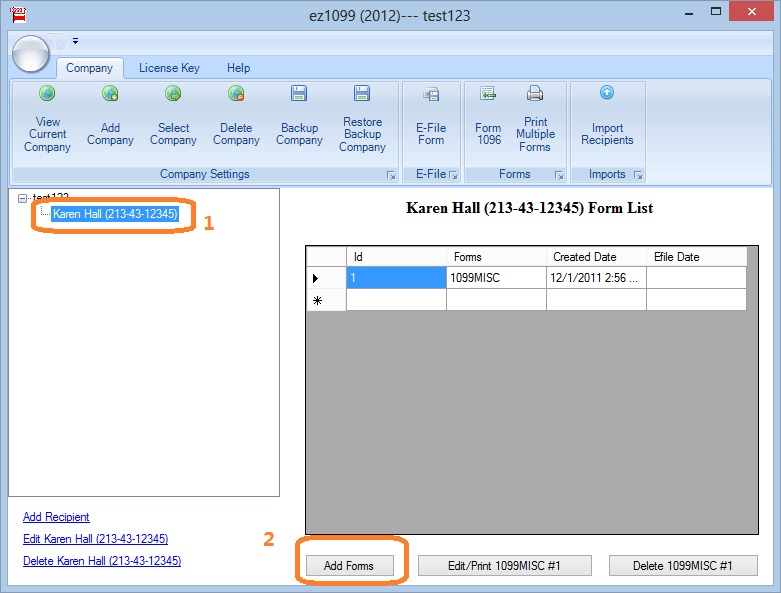

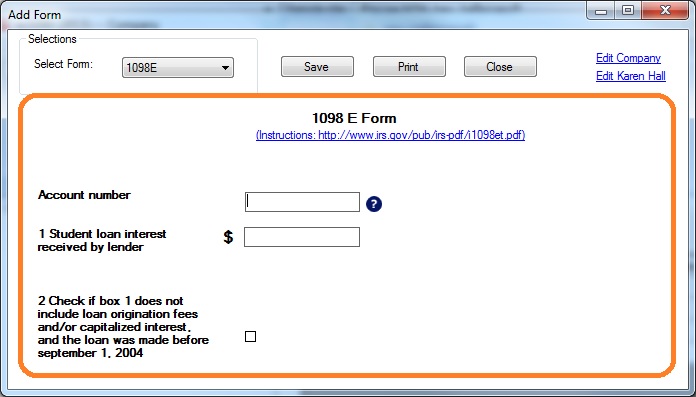

Step 1: Add a new 1098 form

Start ez1099 software, select the recipient and click the Add Form button

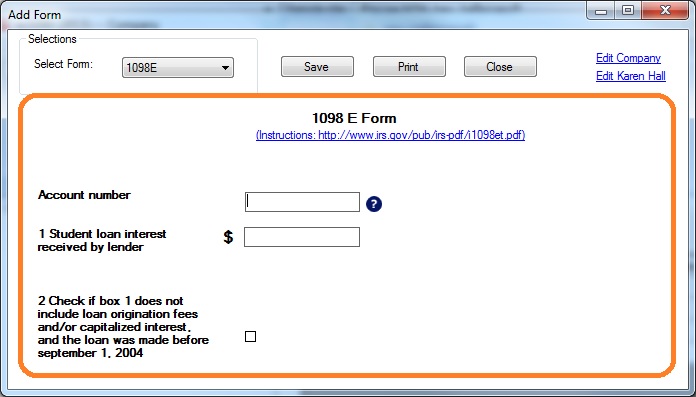

Step 2: Enter 1098 form information

Enter form details. if you have questions, you can also check Form 1098 Instructions at

https://www.irs.gov/pub/irs-pdf/i1098et.pdf

If you are ready to print form, you can click the "SAVE" button to save your changes first and click the "PRINT" button to view print options.

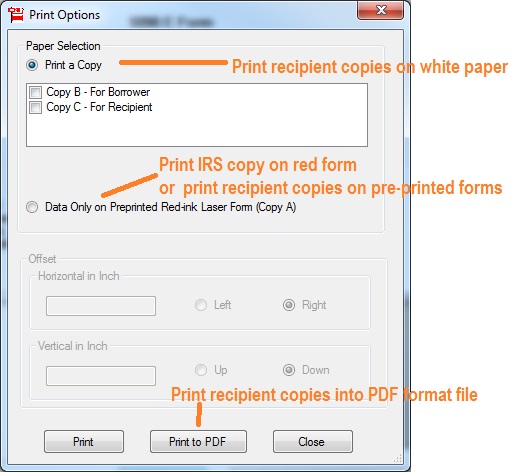

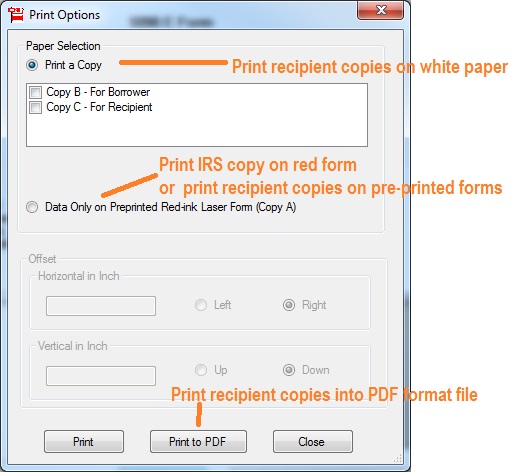

Step 3: Print 1098 form

If you are ready to print form, you can click the "SAVE" button to save your changes first and click the "PRINT" button to view print options.

Recipient copies:

- You can print form on white paper

- Or you can fill data on pre-printed forms by choosing data only option for copy A

IRS copy:

The Red-ink form is required since IRS does not certify black-and-white substitute form. You need to choose the "Data only" option

PDF files

You can click the "PRINT TO PDF" button to print recipient copies into PDF files. However, this feature is only available for advanced version.

Note:

Multiple forms printing

If you need to print multiple IRS copies for different recipients at the same time, please check this article on how to multiple copies of 1099s form at the same time

eFile 1098-E

If you need to efile your forms, you can view this article on How to eFile 1099s form