1099 Electronic Filing: How to Upload 1099 eFile to IRS Site

ez1099 software can paper print 1099-misc and other 1099 forms than you can mail to IRS. If you decide to go green this tax season, ez1099 software can also generate the efile document that you can upload to IRS site for electronic filing.

Here are the steps:

Step 1: Start ez1099 software and generate the 1099 efile document

If you have not generated the 1099 efile document, you can refer to this article for step by step guide on

how to generate the 1099 Efile document.

Step 2: Log on IRS site and upload the 1099 efile document

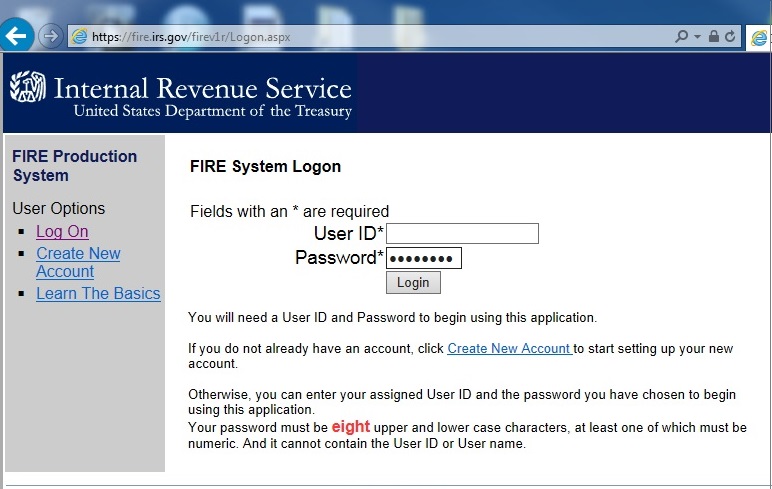

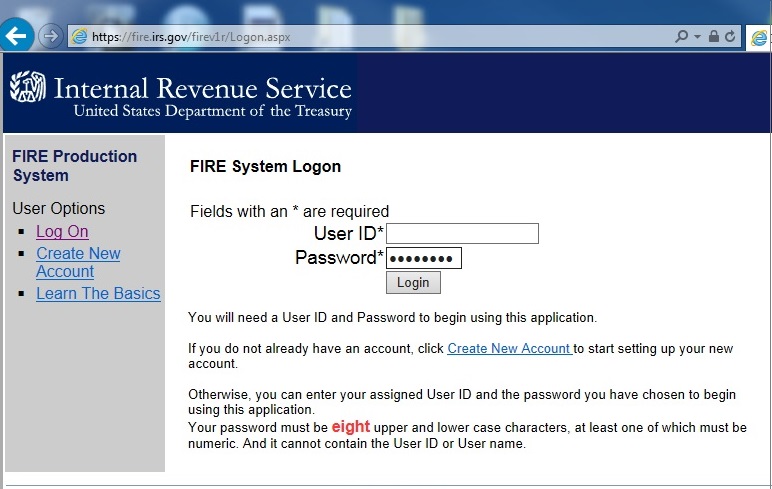

1. Open IRS site. The IRS efile link is

https://fire.irs.gov/Logon.aspx

2. Enter your USER ID and Password to log on

If you are a new user, you need to create a FIRE account on the FIRE system. You need enter your company name, company address, company phone number, contact name and email address. You can create the account before you get your transmitter control code.

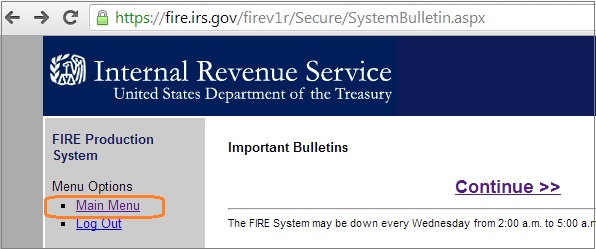

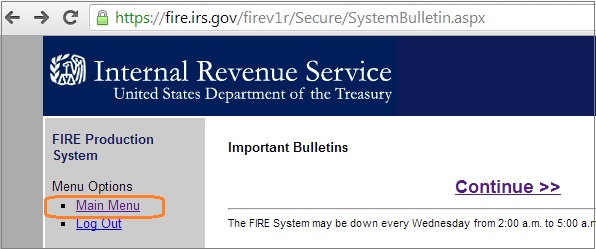

3. Then go to Main Menu

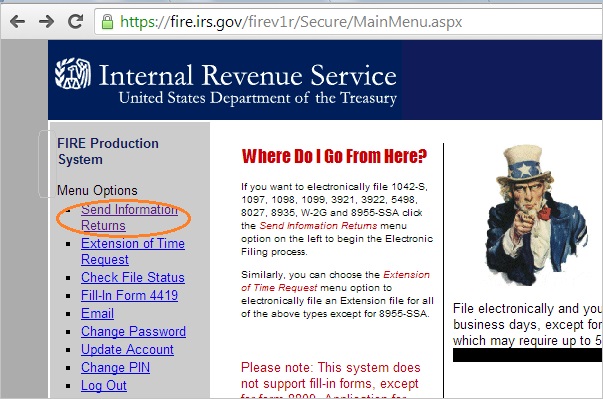

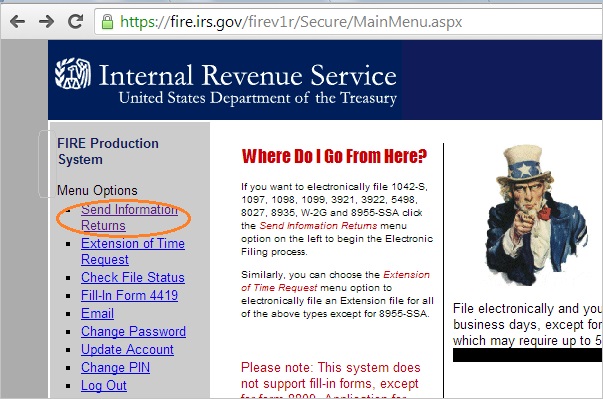

3. Then go to Main Menu  4. Then choose the option "Send Information Returns"

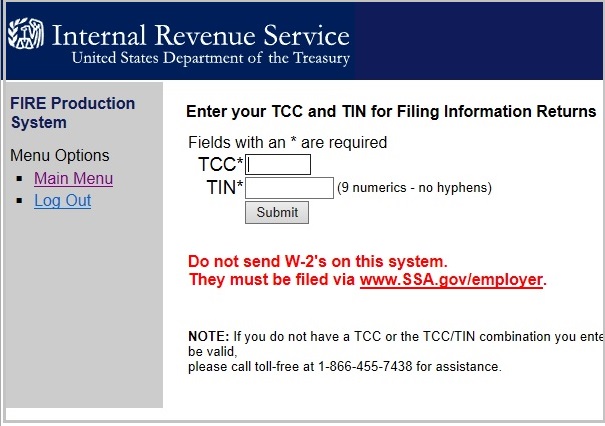

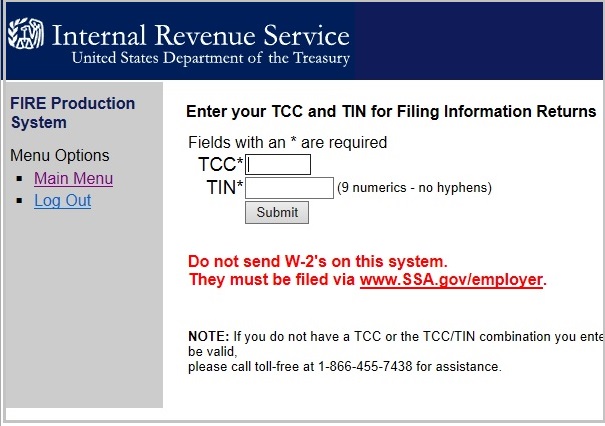

4. Then choose the option "Send Information Returns"  5. Enter TCC and TIN for filing inforamtion return

5. Enter TCC and TIN for filing inforamtion return

If you are a new user of IRS EFILE service, you need to apply TCC code (Transmitter Control Code) to generate the efile document. You can learn more on

how to apply TCC code in NOTE part below.

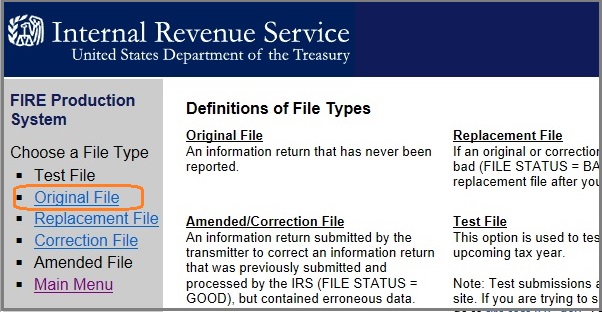

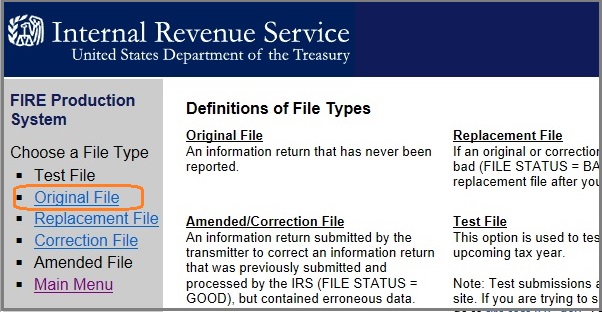

6. Select "Orginal File" option

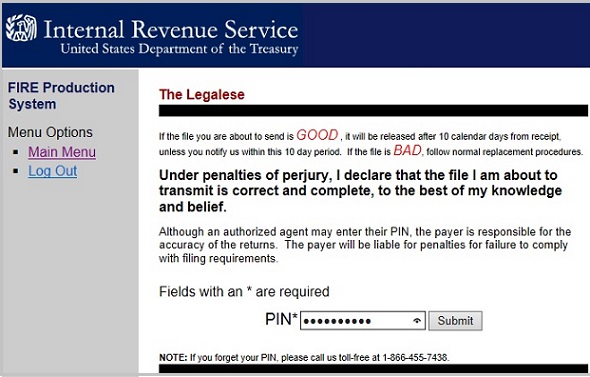

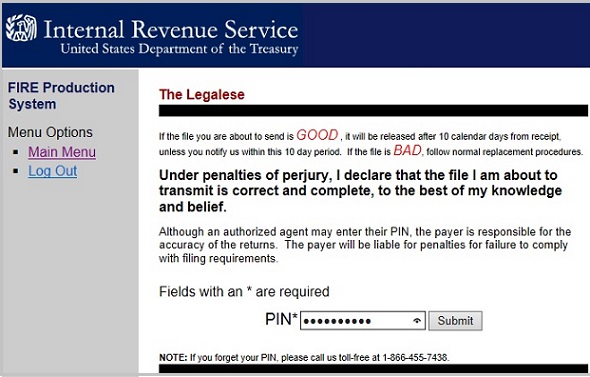

6. Select "Orginal File" option  7. Enter your pin.

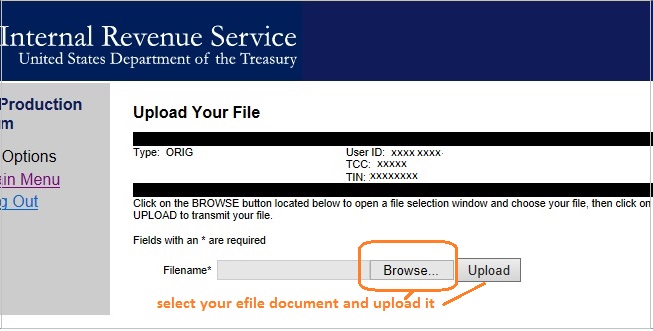

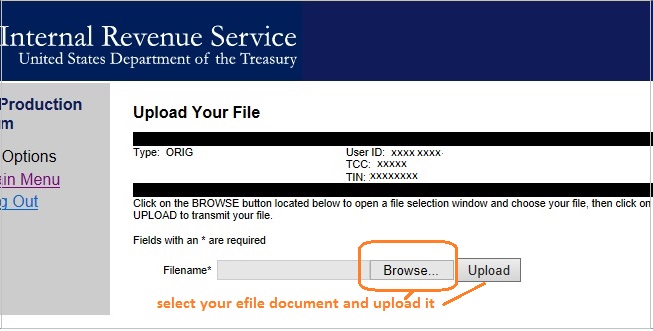

7. Enter your pin.  8. Upload the efile document you created in step 1

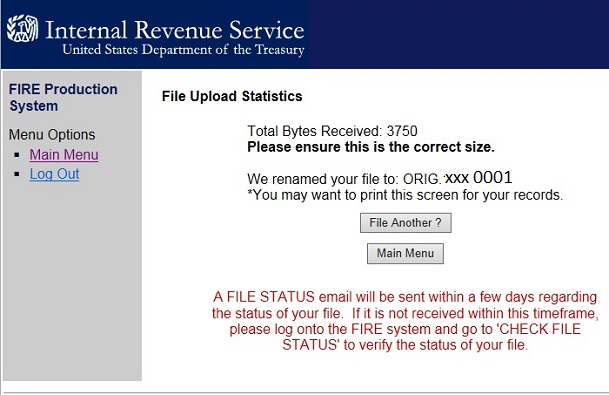

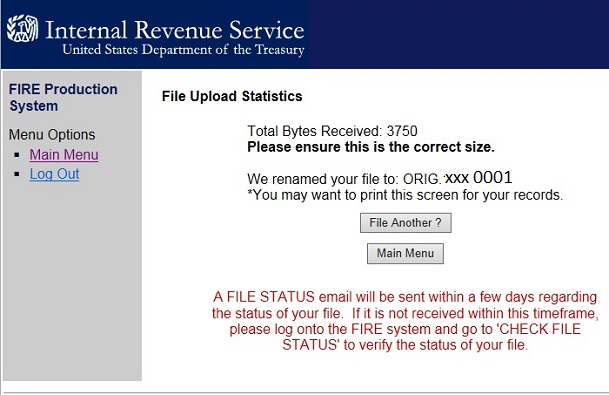

8. Upload the efile document you created in step 1  9. you will see message on screen after you load your efile document

9. you will see message on screen after you load your efile document

When the upload is complete, the screen will display the total bytes received and display the name of the file just

uploaded. If this is not displayed on your screen, IRS probably did not receive the file. To verify, go to Check File

Status option on the main menu. If the file name is displayed and the count is equal to 0 and the results indicate not yet

processed, then we received the file. If the filename is not displayed, send the file again.

You can click here to learn more details on

how to look up 1099 tax return status after efile it.

Note

1. If you are a new user of IRS EFILE service, you need to apply TCC code (Transmitter Control Code) to generate the efile document. You also need to create a FIRE account to upload your file.

How to request a transmitter control code (TCC)

If you are new user of IRS efile service, you should request a transmitter control code (TCC) by filling out IRS Form 4419, "Application for Filing Information Returns Electronically."

Form 4419

https://www.irs.gov/pub/irs-pdf/f4419.pdf

You need to mail or fax the form to the IRS at least 30 days before the deadline for filing 1099s. The IRS will send your 5-character transmitter control code by mail once the application is approved.

Internal Revenue Service

Information Returns Branch

230 Murall Drive, Mail Stop 4360

Kearneysville, WV 25430

Or fax your completed Form 4419 to:

877-477-0572 (toll-free)

304-579-4105 (not toll-free)

Upon approval, a five-character alpha/numeric Transmitter Control Code (TCC) will be assigned and mailed to you. Form 4419 should be submitted to IRS at least 30 days before the due date of the returns for current year processing.