With ez1099 2025, you have two options for e-filing 1099s and 1096 forms with the IRS:

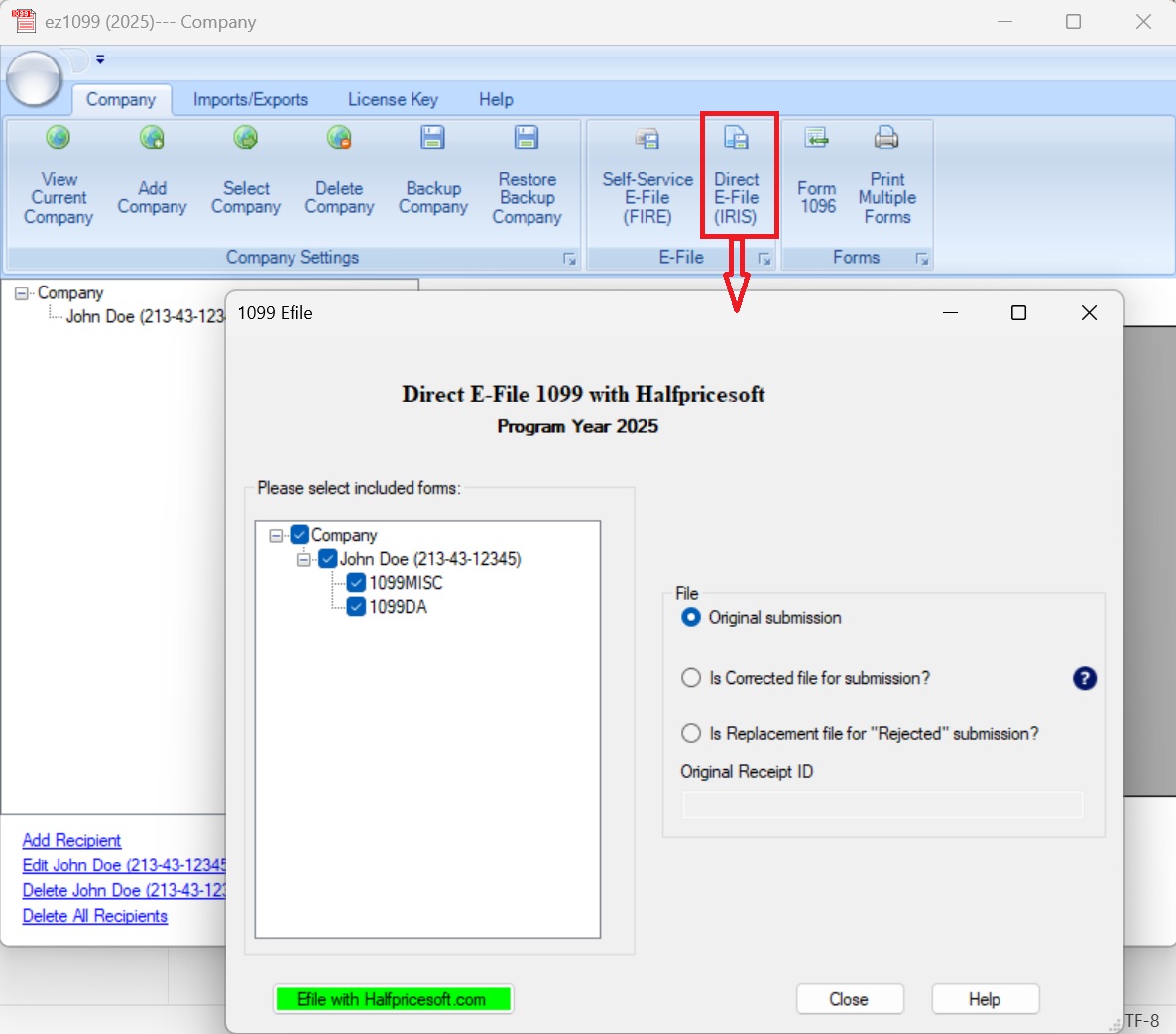

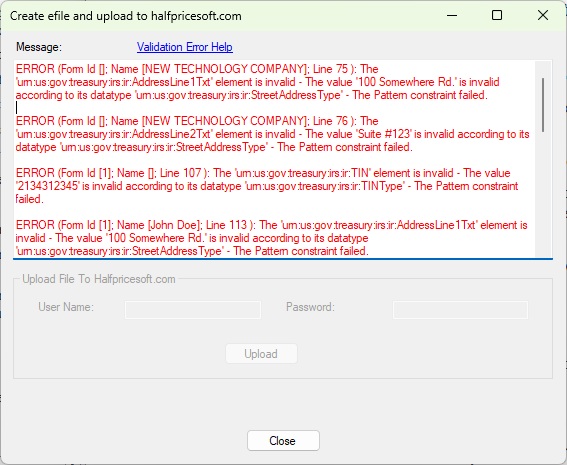

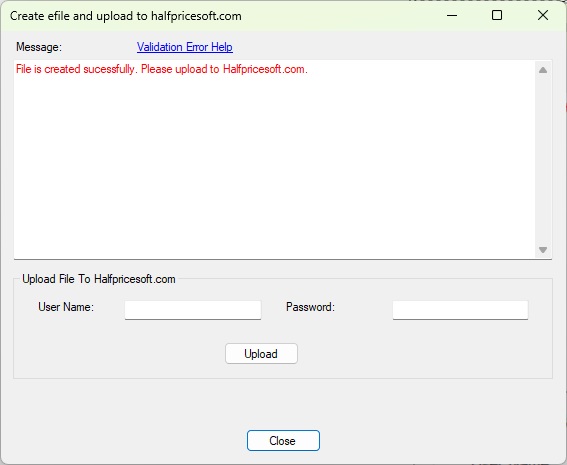

Option 1. Direct to the IRS with ez1099's Built-In eFiling Service (Recommended)

- No TCC required; we file on your behalf.

- Upload 1099/1096 forms within ez1099.

Option 2. Self-Filing

- Requires your own TCC (Transmitter Control Code).

- ez1099 generates the required e-file document (TXT file), which you can upload to the IRS FIRE system using your own TCC.

Compare two options: 1099 self-filing vs in-app efiling service

Up through tax year 2025, the FIRE system will remain available for most 1099 forms, but it will not support Form 1099-DA (Digital Asset Proceeds).

ez1099 2025 users are encouraged to take advantage of the new built-in direct IRIS e-file service, especially if you need to file the new 1099-DA form or prepare for the upcoming transition away from FIRE.

ez1099 generates the required e-file document (TXT file), which you can upload to the IRS FIRE system using your own TCC. Learn more:

Step by step guide: how to apply TCC, generate the 1099/1096 eFile document and submit to IRS FIRE