Payroll and Accounting Guides

ezPaycheck Guide ezPaycheck Mac Guide ezPaycheck Features Payroll by State E-File 941 Guide ezAccounting Guide

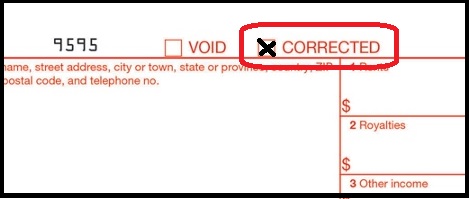

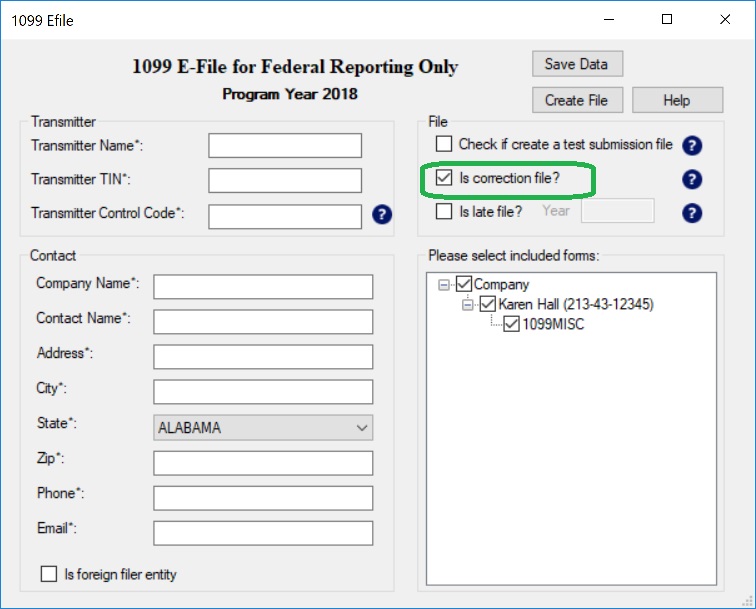

| Error Type 1 | Correction |

| Incorrect money amount(s), code, or

checkbox

A return was filed when one should not have been filed. These errors require only one return to make the correction. Caution: If you must correct a TIN or a payee name, follow the instructions under Error Type 2. | A. Form 1097, 1098, 1099, 3921, 3922, 5498, or W-2G 1. Prepare a new information return. 2. Enter an X in the CORRECTED box (and date (optional)) at the top of the form. 3. Correct any recipient information such as money amounts. Report other information as per the original return. B. Form 1096 1. Prepare a new transmittal Form 1096. 2. Provide all requested information on the form as it applies to Part A, 1 and 2. 3. File Form 1096 and Copy A of the return with the appropriate service center. 4. Do not include a copy of the original return that was filed incorrectly. |

| Error Type 2 | Correction |

| No payee TIN (SSN, EIN, QI-EIN, or

ITIN), or Incorrect payee TIN, or Incorrect payee name, or Original return filed using wrong type of return (for example, a Form 1099-DIV was filed when a Form 1099-INT should have been filed). Two separate returns are required to make the correction properly. Follow all instructions for both Steps 1 and 2. | Step 1. Identify incorrect return

submitted. 1. Prepare a new information return. 2. Enter an "X" in the "CORRECTED" box (and date (optional)) at the top of the form. 3. Enter the payer, recipient, and account number information exactly as it appeared on the original incorrect return; however, enter 0 (zero) for all money amounts Step 2. Report correct information. A. Form 1097, 1098, 1099, 3921, 3922, 5498, or W-2G 1. Prepare a new information return. 2. Do not enter an "X" in the "CORRECTED" box at the top of the form. Prepare the new return as though it is an original. 3. Include all the correct information on the form including the correct TIN and name. B. Form 1096 1. Prepare a new transmittal Form 1096. 2. Enter one of the following phrases in the bottom margin of the form. 4. File Form 1096 and Copy A of the return with the appropriate service center. 5. Do not include a copy of the original return that was filed incorrectly. |