Step 4: Submit the Correction File

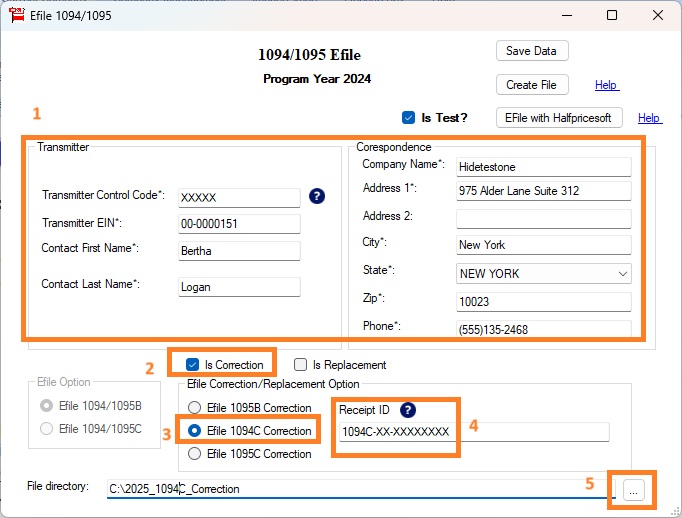

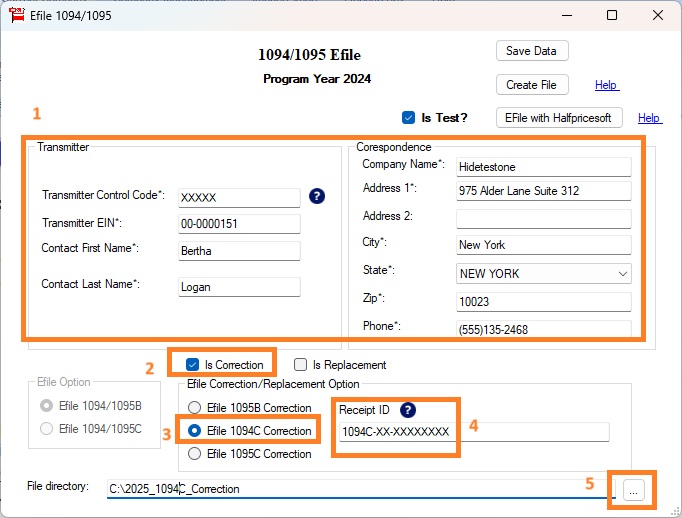

Click the top menu "File IRS 1094/1095" to open the eFile screen.

- Check the box labeled "Is Correction".

- Check the option "Efile 1094C Correction".

- Enter the Receipt ID of the submission you are correcting.

- Change the file directory(Optional).

- Click "Save Data".

Option 1: Use ez1095 In-App eFiling Service

If you're using the built-in eFiling service within ez1095, simply click the "eFile with Halfpricesoft" button to submit your correction file directly.

Learn more at:

How to upload forms with ez1095 in-app service Option 2: Self-Filing Through IRS AIR Portal

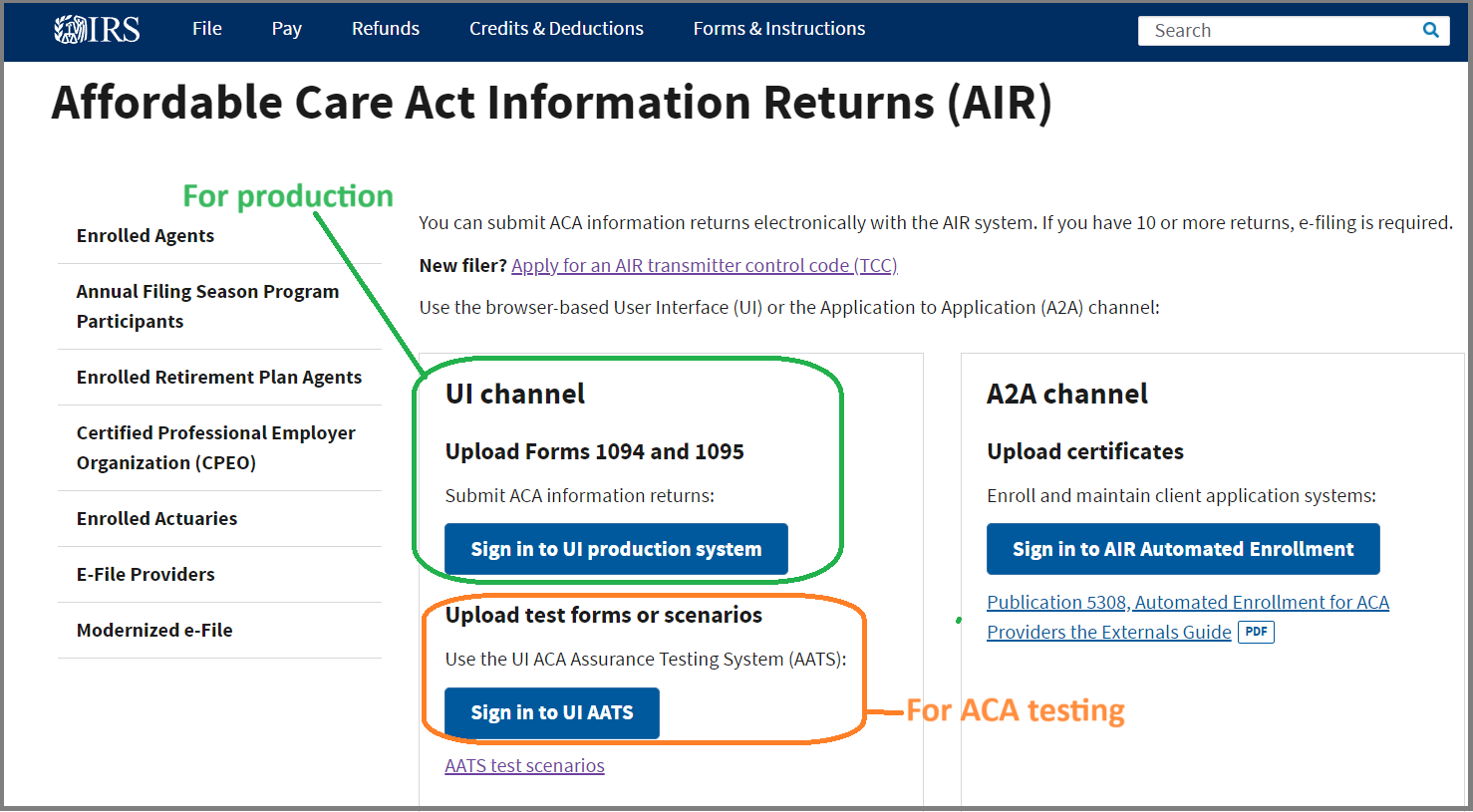

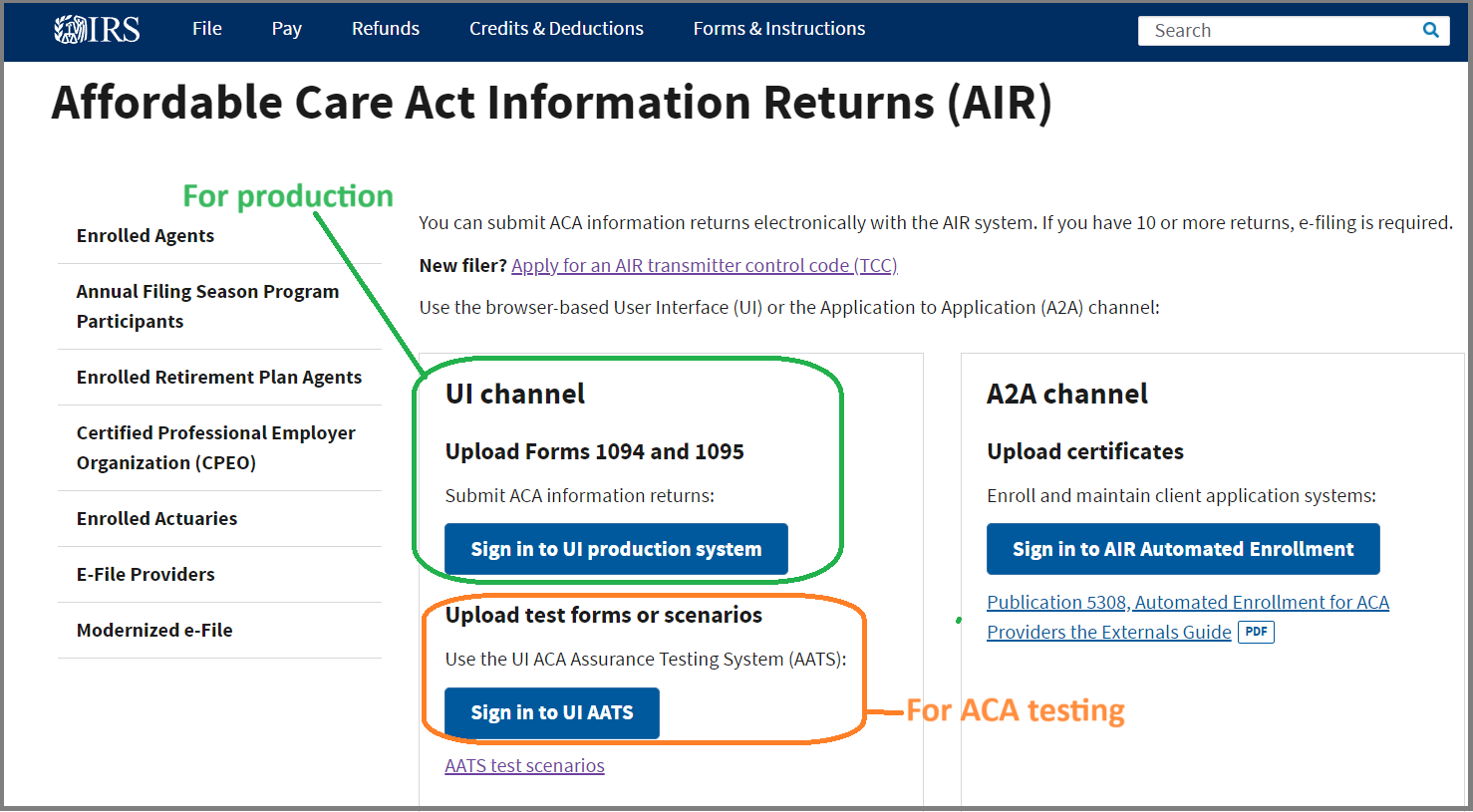

If you are submitting the correction file with your own IRS account and TCC, follow the steps below:

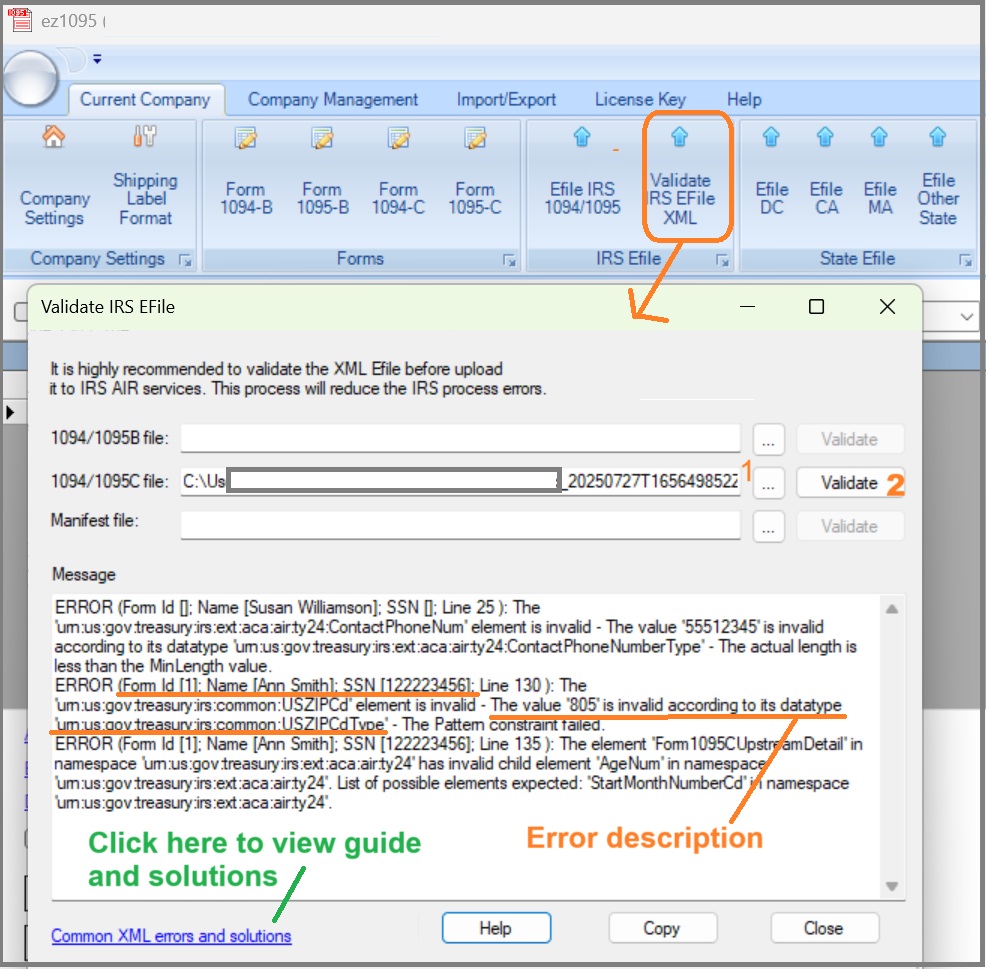

4.1 Generate the efile document

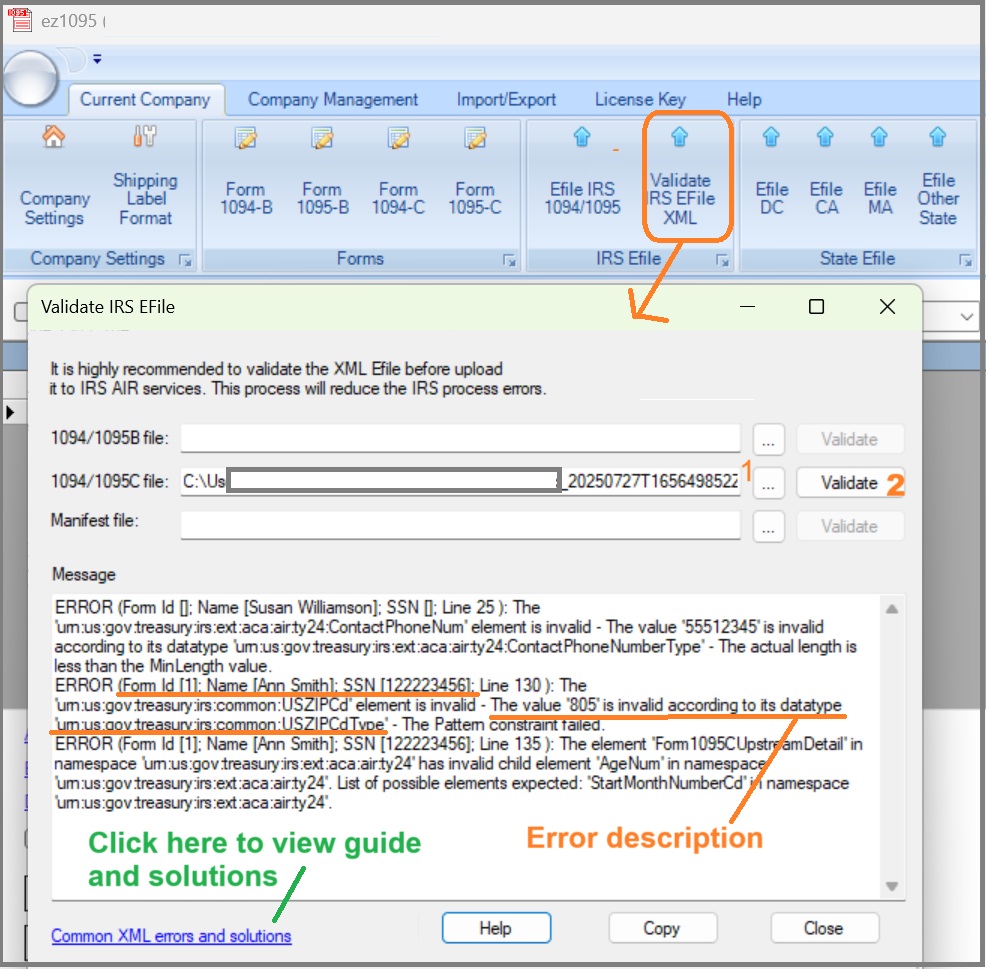

4.2 Validate XML files

4.3 Upload the XML files to the IRS

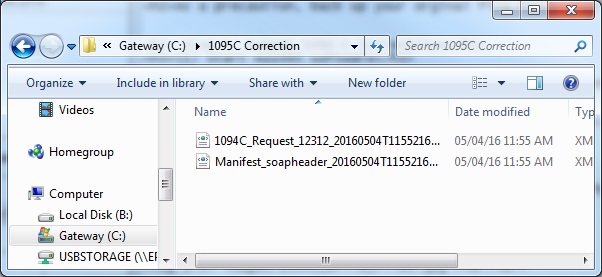

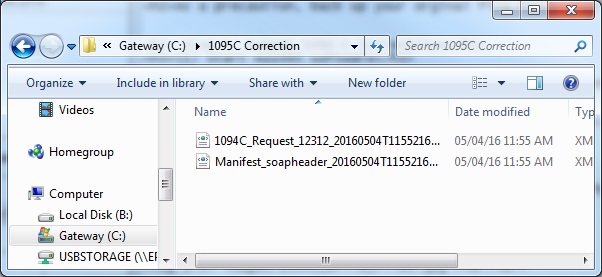

There are two files to be uploaded.

"Manifest_soapheader_xxxxxx.xml"

This is the manifest file.

"1094X_Request_YourTCC_xxxxx.xml".

This is the data file.

PLEASE DO NOT MODIFY FILES. Please record the Receipt ID after uploading.

Learn more at: How to upload the XML files to the IRS