How To Fill Out And File IRS Form W-2C

(for tax year to 2024)

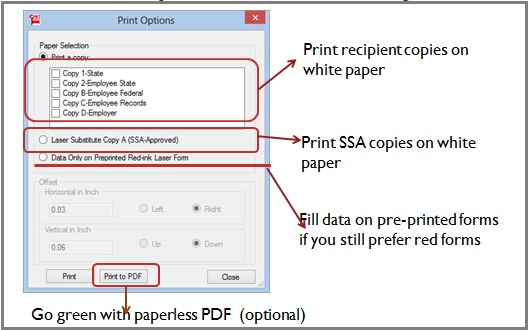

Preprinted W2C and W3C forms are NOT necessary!

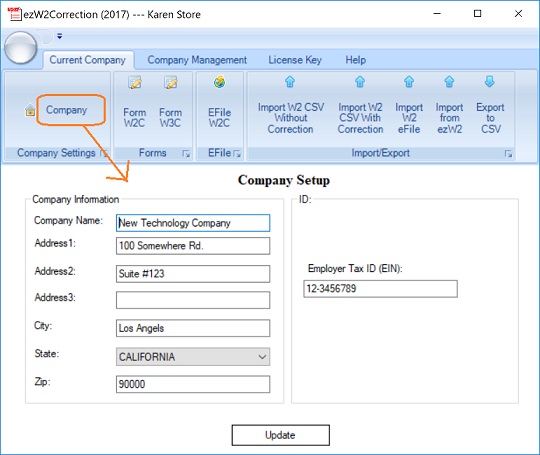

As an employer, you are required to

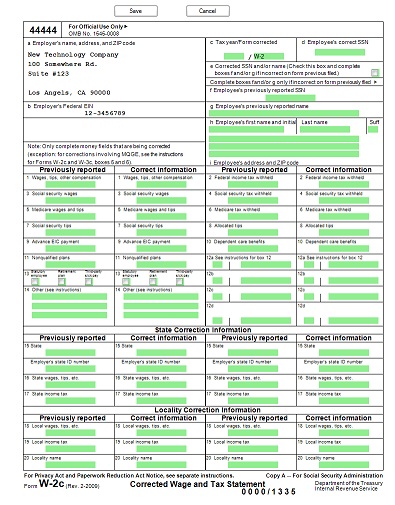

print W-2 forms for your employees and file w-2 form to government. If you discover an error, you need to file Forms

W-2c (Corrected Wage and Tax Statement) and

W-3c (Transmittal of Corrected Wage and Tax Statement) as soon as possible..

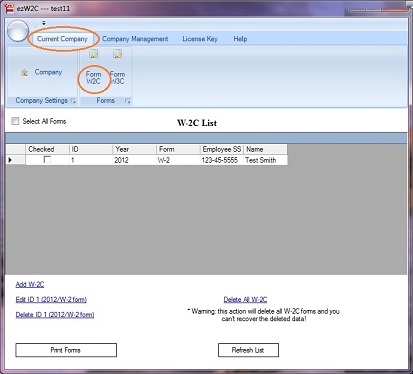

To correct a Form W-2 you have already submitted, you will need to file a Form W-2c with a separate Form W-3c for each year requiring correction. You need to file a Form W-3c whenever you file a Form W-2c, even if you are only filing a Form W-2c to correct an employee's name or Social Security number (SSN).