ezW2 1099-nec Electronic Filing: How to Check File Status

ezW2 software can paper print 1099-nec forms than you mail to IRS. If you decide to go green this tax season, ezW2 software can also generate the efile document that you can upload to IRS site for electronic filing. You can learn more details here

It is the filer's responsibility to check the status of submitted 1099 files. If you do not receive an email within five (5) business

days or if you receive an email indicating the file is bad, log back into the IRS FIRE System and select "Check File Status".

Here are the steps on how to look up tax return status after you efile 1099 tax return to IRS:

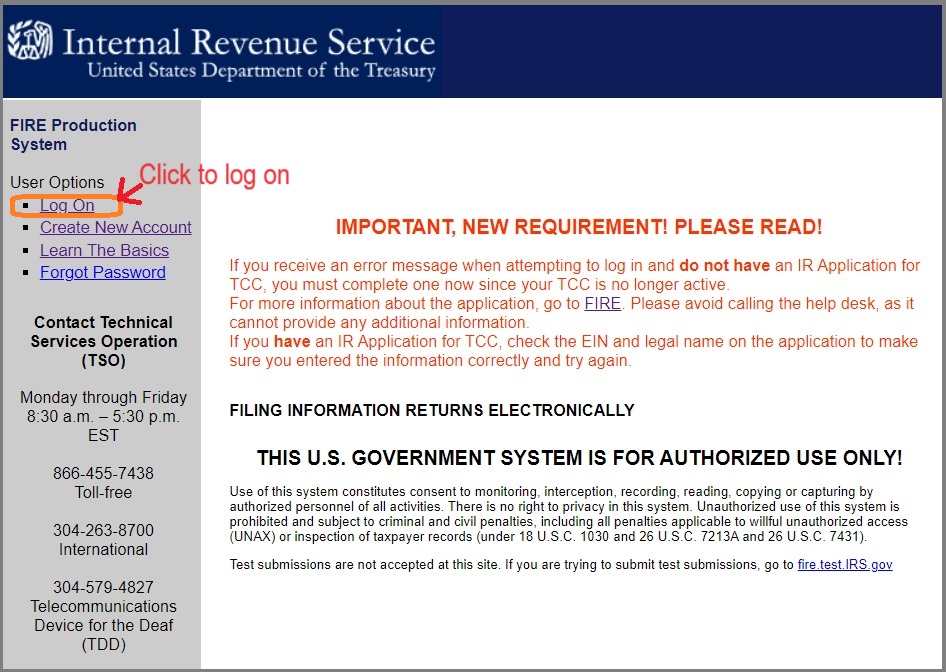

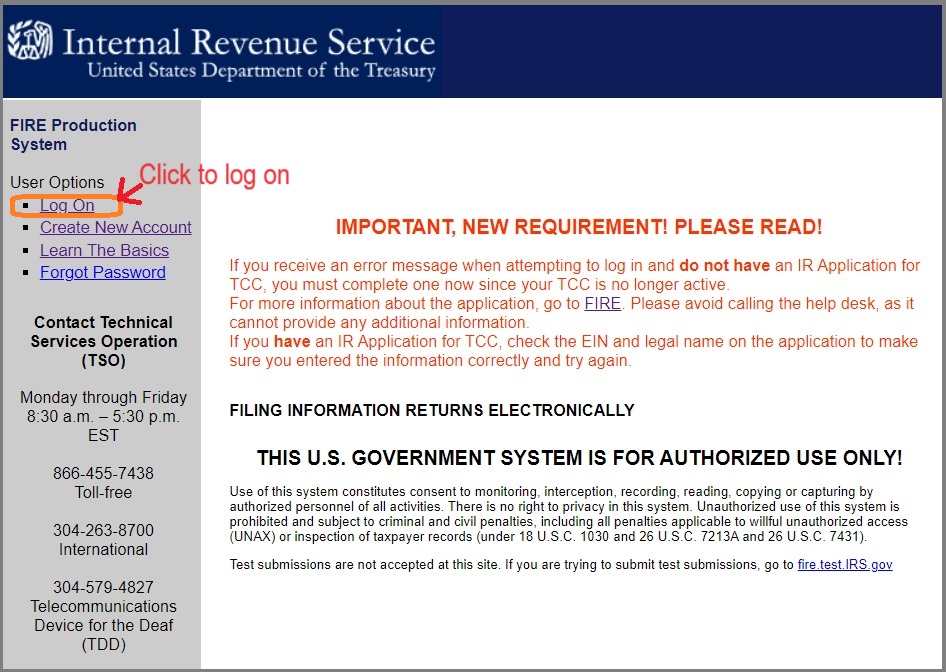

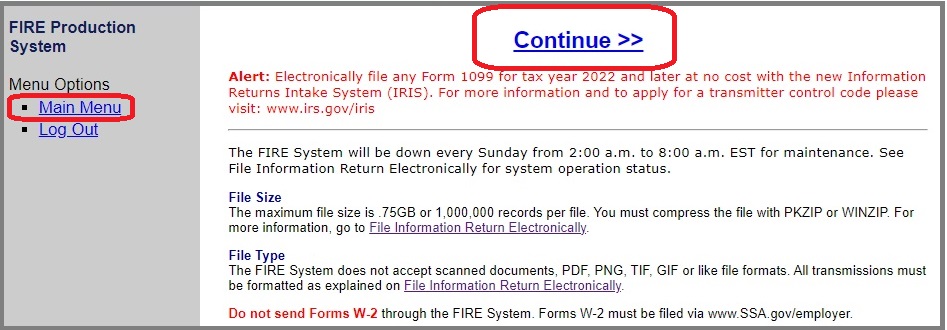

1. Visit IRS FIRE site.

1.1 The IRS efile link is

https://fire.irs.gov/

1.2 Click the left menu "Log on"

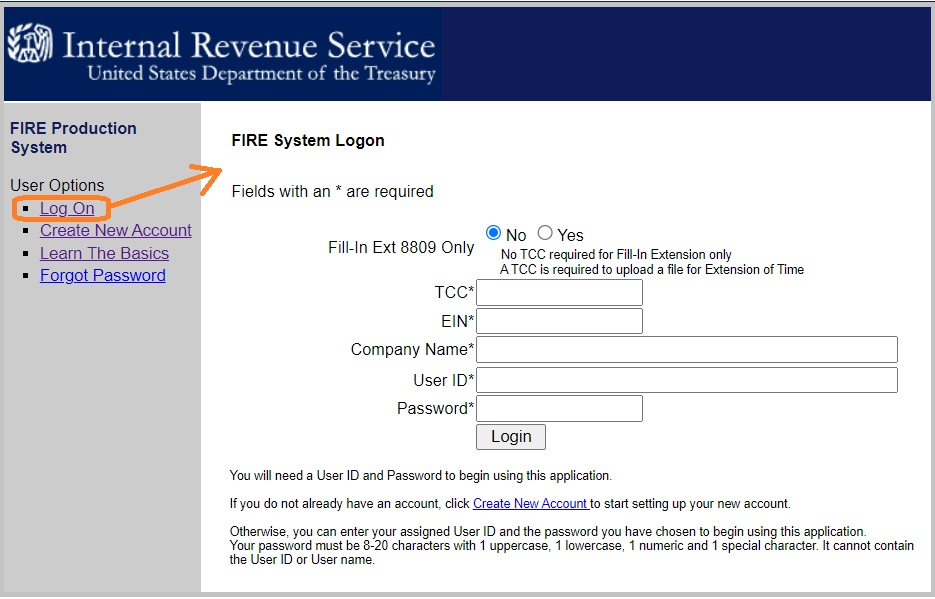

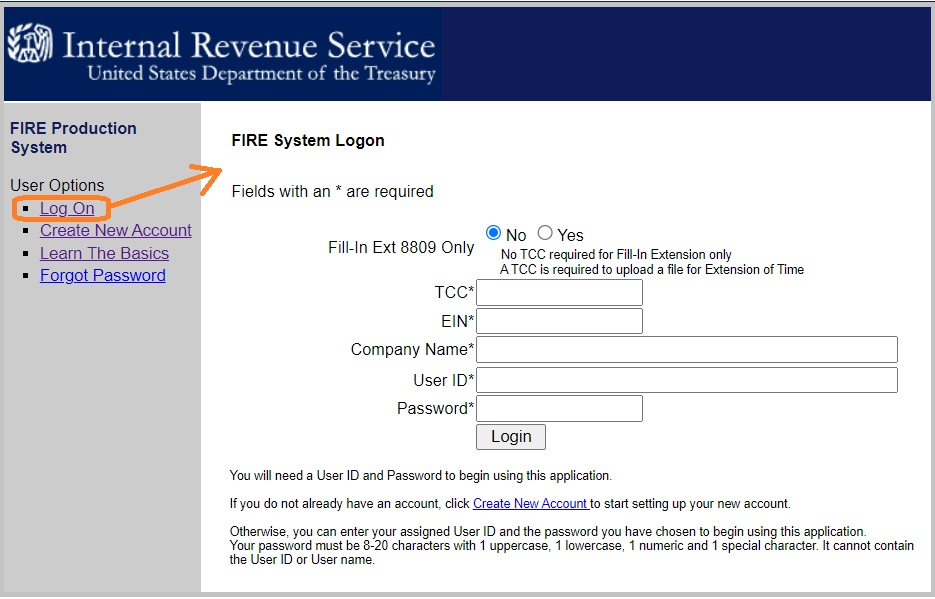

2. Enter the required information to log on

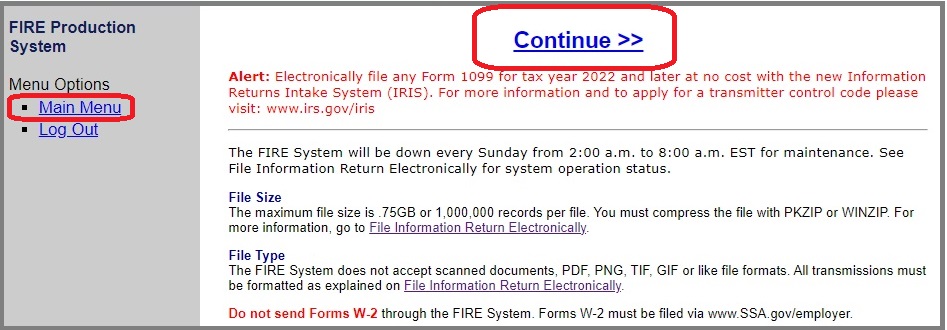

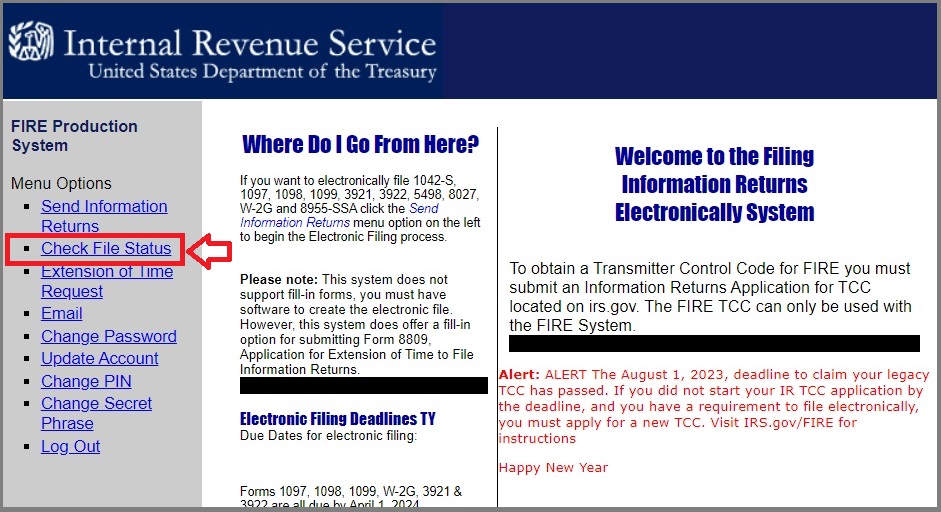

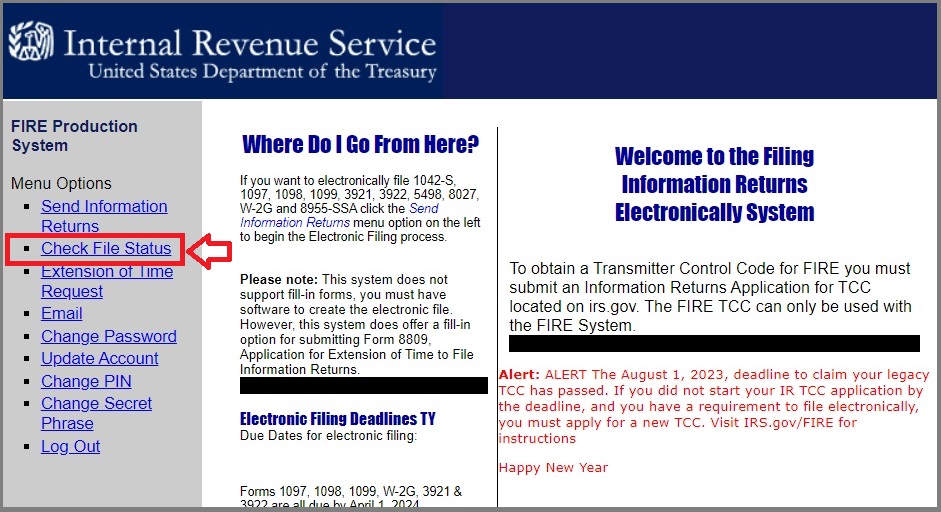

3. Then go to Main Menu

4. Then choose the option "Check File Status"

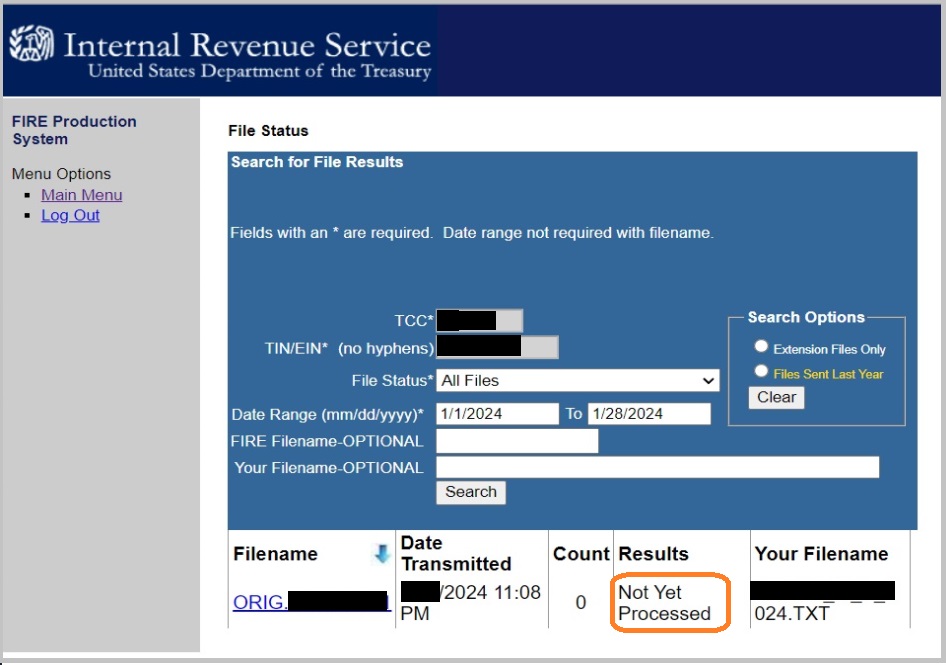

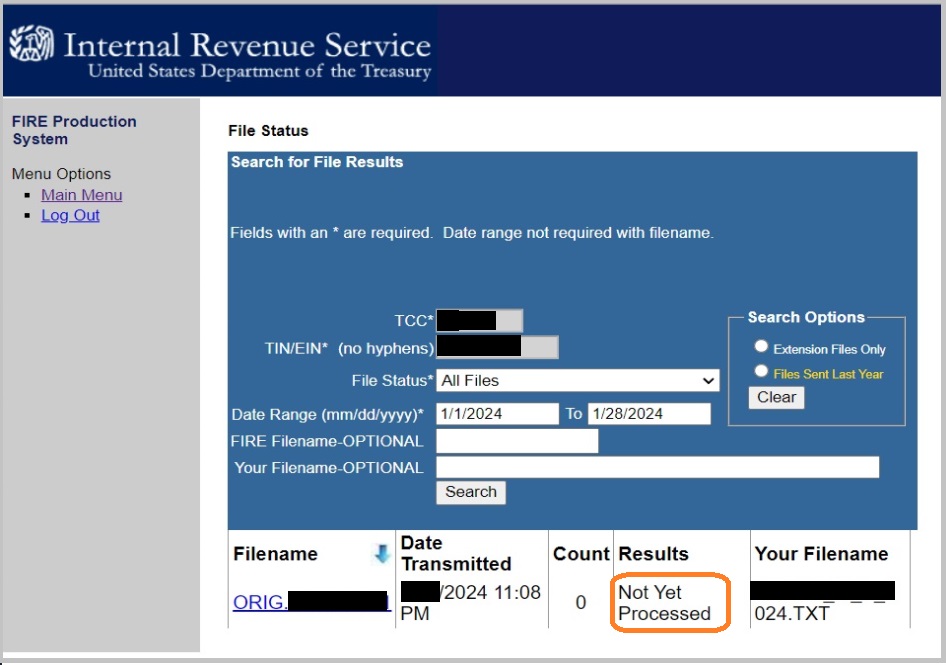

5. Enter TCC and TIN to search for file status

Description of the File Status Results:

-

Good, Not Released - The filer is finished with this file if the "Count of Payees" is correct. The file is

automatically released after ten calendar days unless the filer contacts the IRS within this timeframe.

-

Good, Released - The file has been released for IRS processing.

-

Bad - The file has errors. Click on the filename to view the error message(s), fix the errors, and resubmit the

file timely as a "Replacement" file.

-

Not Yet Processed - The file has been received, but results are not available. Please check back in a few

days.