ezAccounting Software - After the Fact Payroll: How to Enter Federal and State Taxes Manually

With after the fact paycheck feature,

ezAccounting payroll software allows customers to enter the federal and state taxes manually.

Accountants can use this feature to record paychecks from clients. Small business owners and HR managers can also use this feature if they switch to ezAccounting software in mid-year and they prefer to enter the old checks one by one into ezAccounting system instead of using

manual YTD feature.

Here are two options:

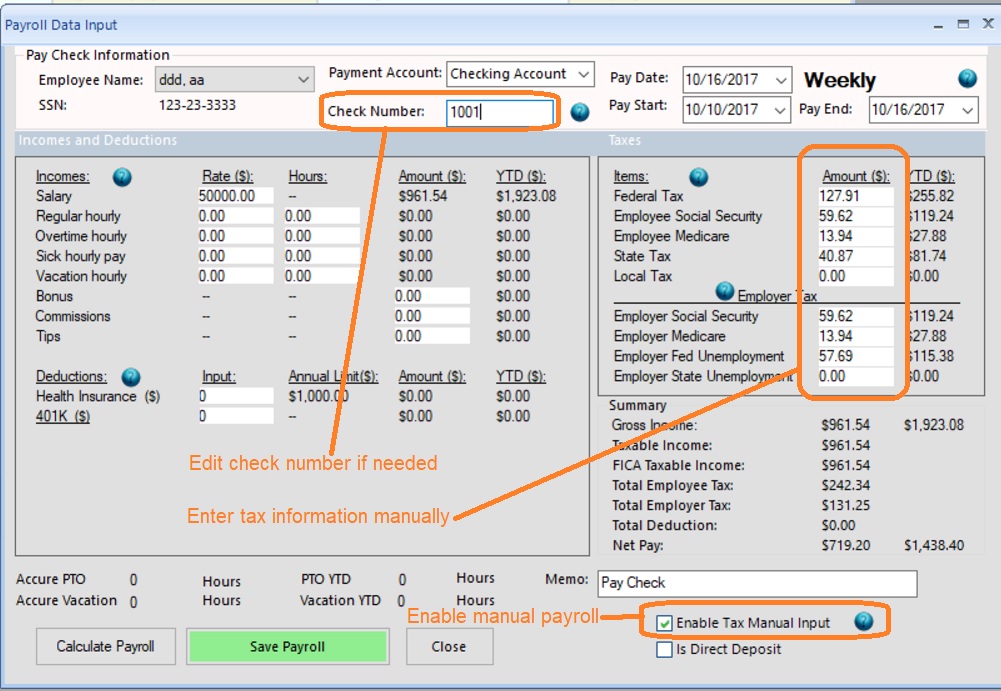

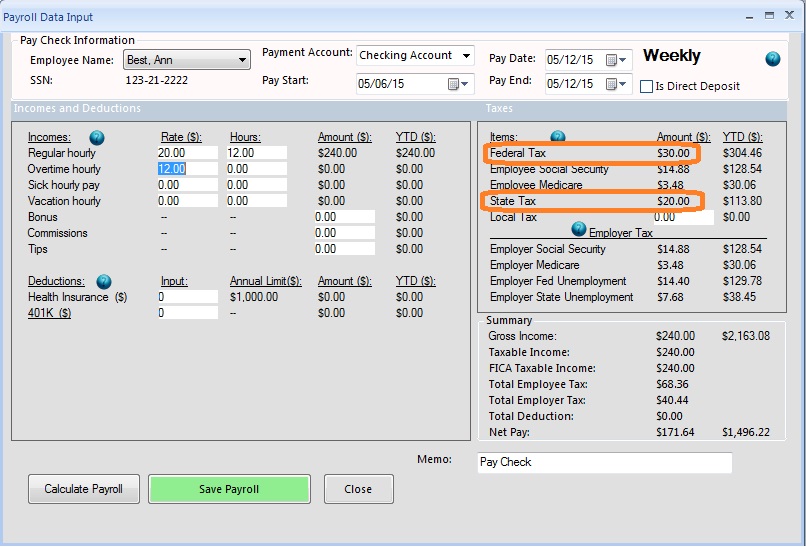

Option 1: Enter taxes manually

For example: Company ABC started ezAccounting from Nov 2017. they need to record the 2 paychecks they issued in Oct. The two paychecks were calculated manually before. ezAccounting 2017 and later will allow customers to enter the tax information manually.

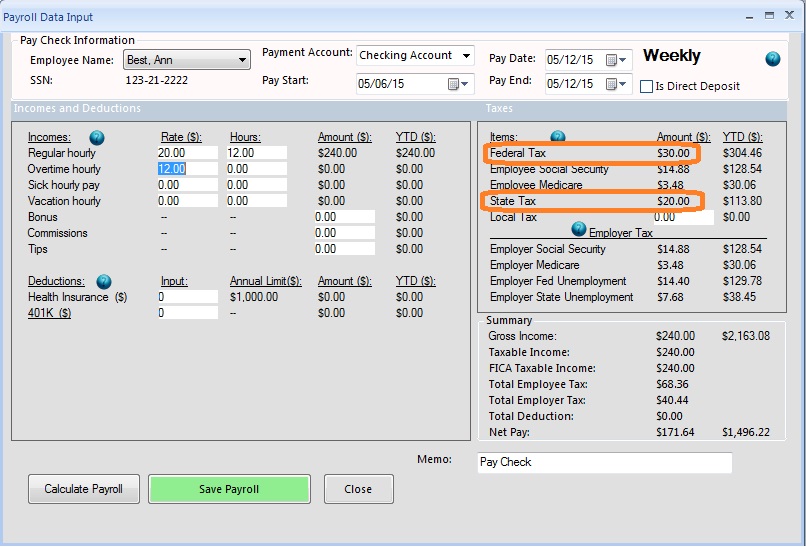

Click to view larger image Option 2: Disable federal and state tax calculation by withholding a fixed amount.

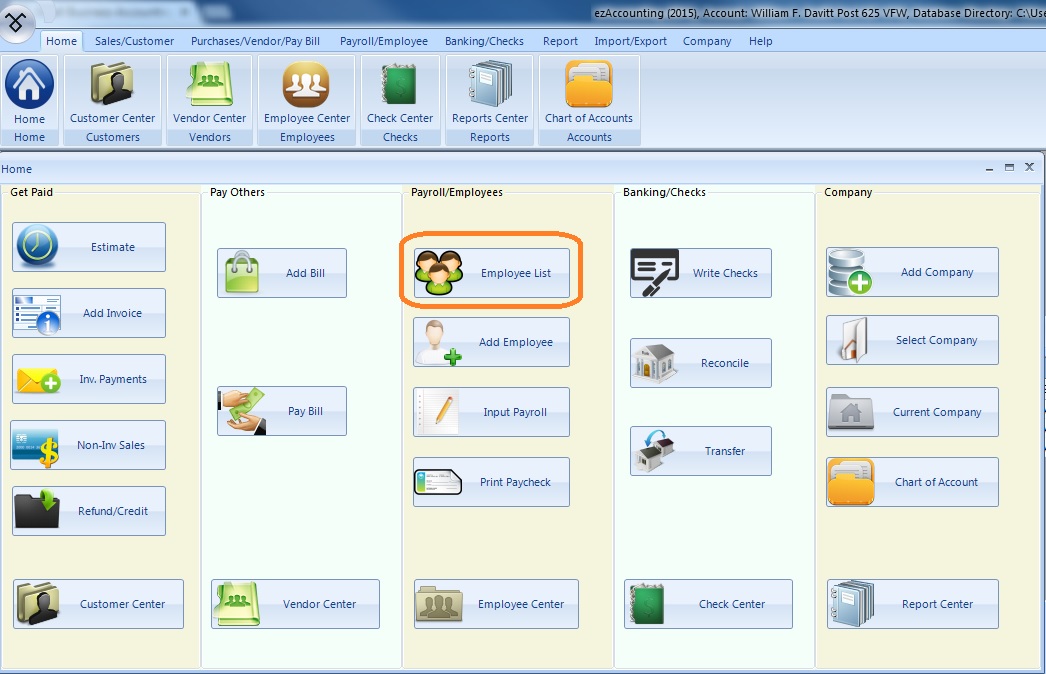

Step 1: Edit employee profile

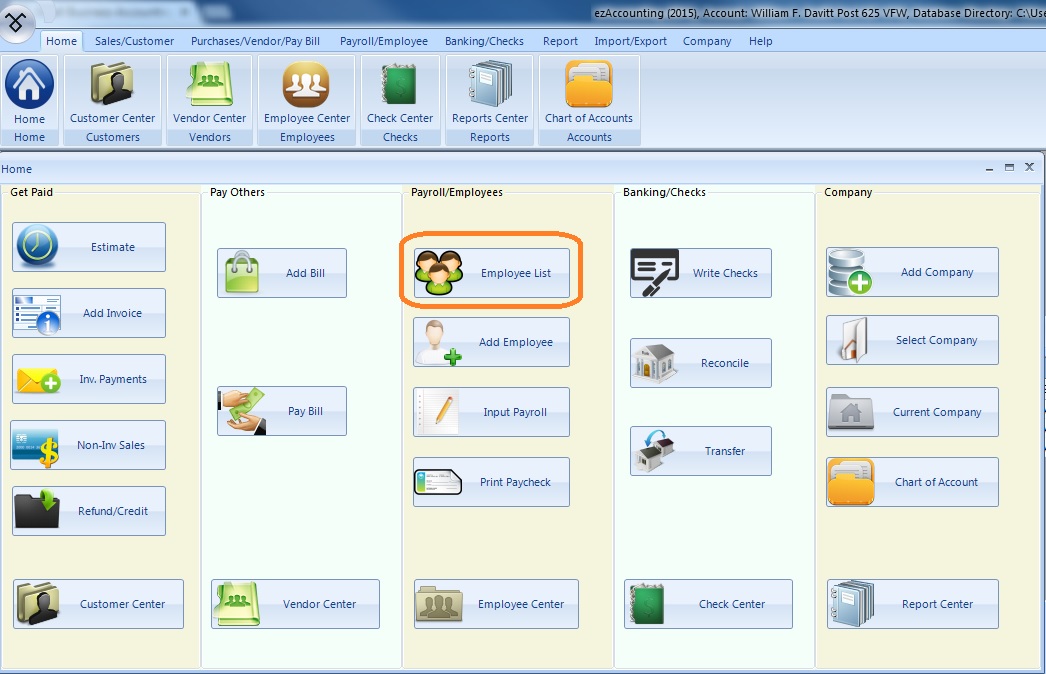

- Click Employee list button on Main Control Panel to view all employees.

Click to view larger image

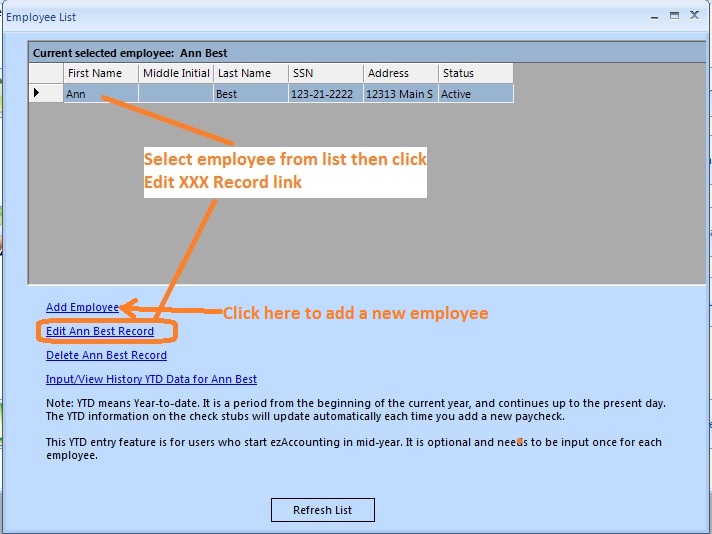

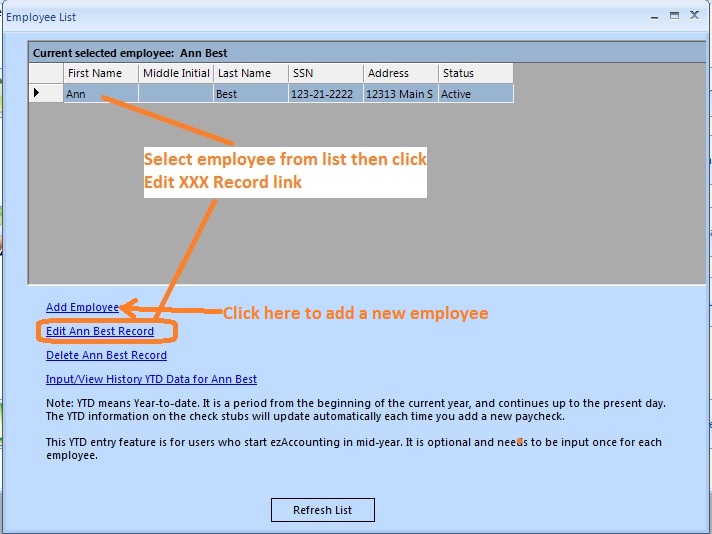

- Select the employee from list and click the "Edit XXX Record" link to edit the settings. (To add a new employee, click the "Add Employee" link.)

Click to view larger image

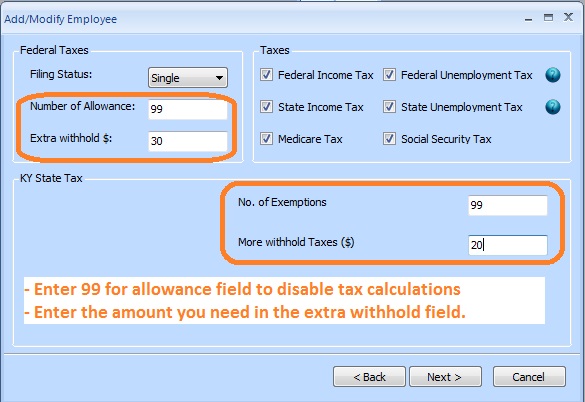

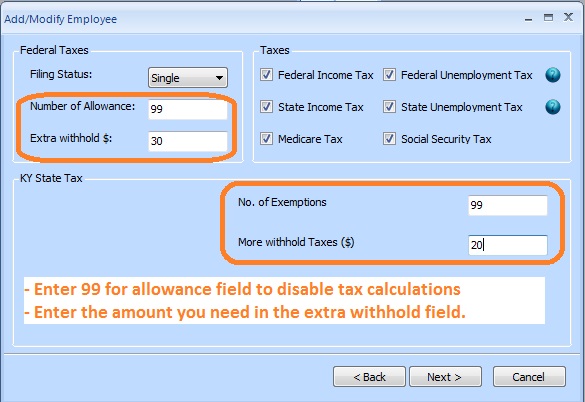

- For Federal tax

Set Number of Allowance for Federal to 99. For the field of Extra withhold, enter the federal tax you need to withhold for that check.

- For State tax

Set Number of Allowance to 99. For the field of Extra withhold, enter the amount you need to withhold for that check.

Click the next button and click finish button to save the changes.

Click to view larger image

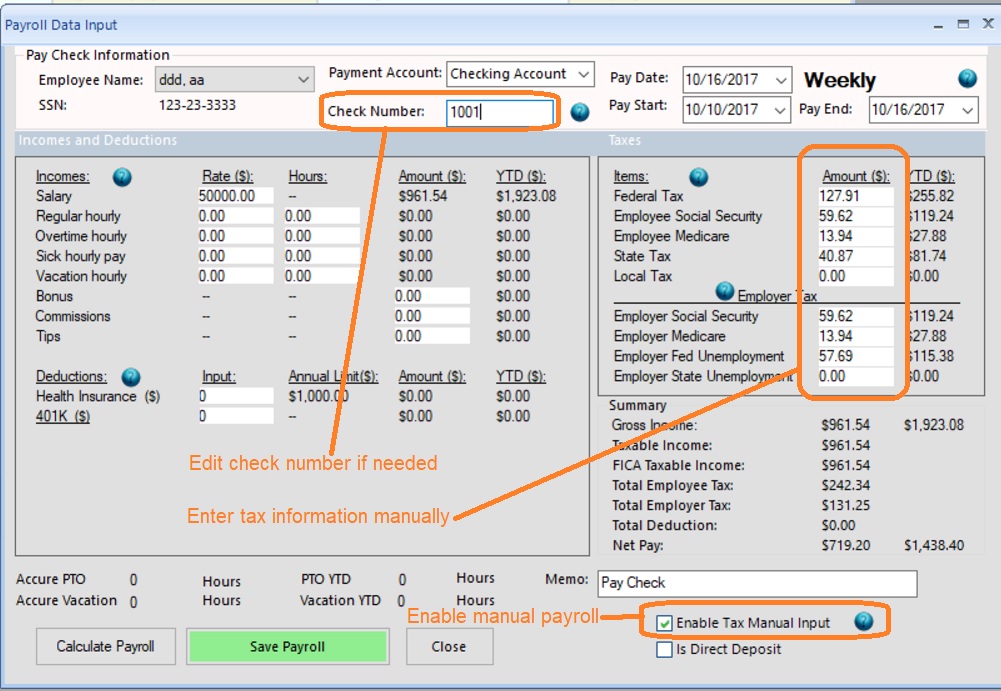

Step 2: Change the check number (optional)

If you need to re-use the same check number on old checks, you can edit the current check number from account set up screen.

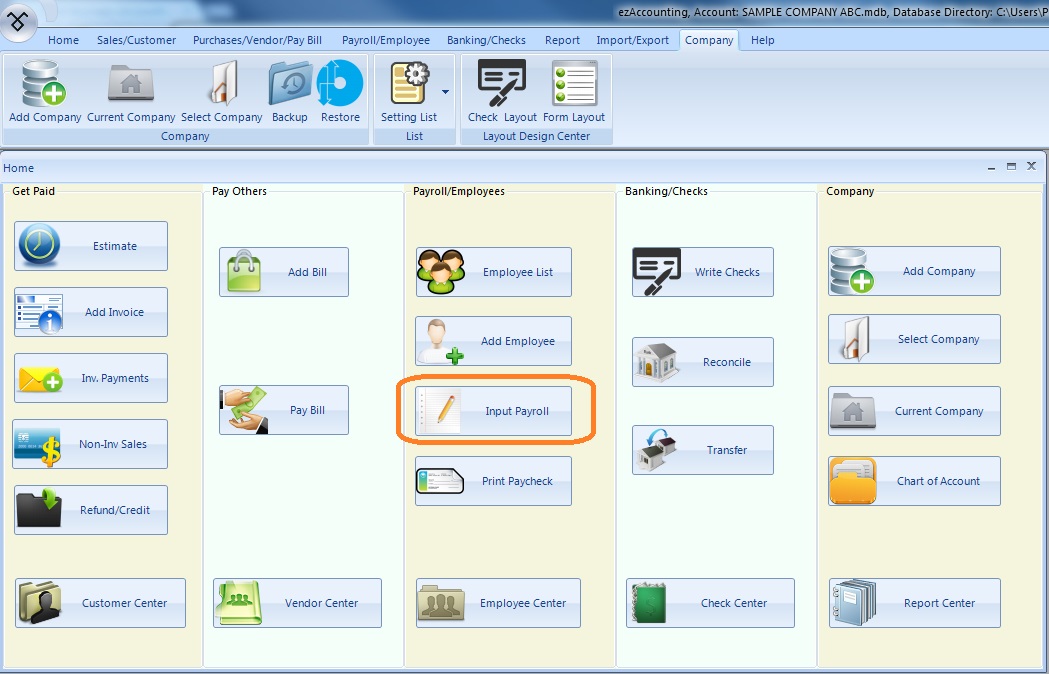

Step 3: Add new check

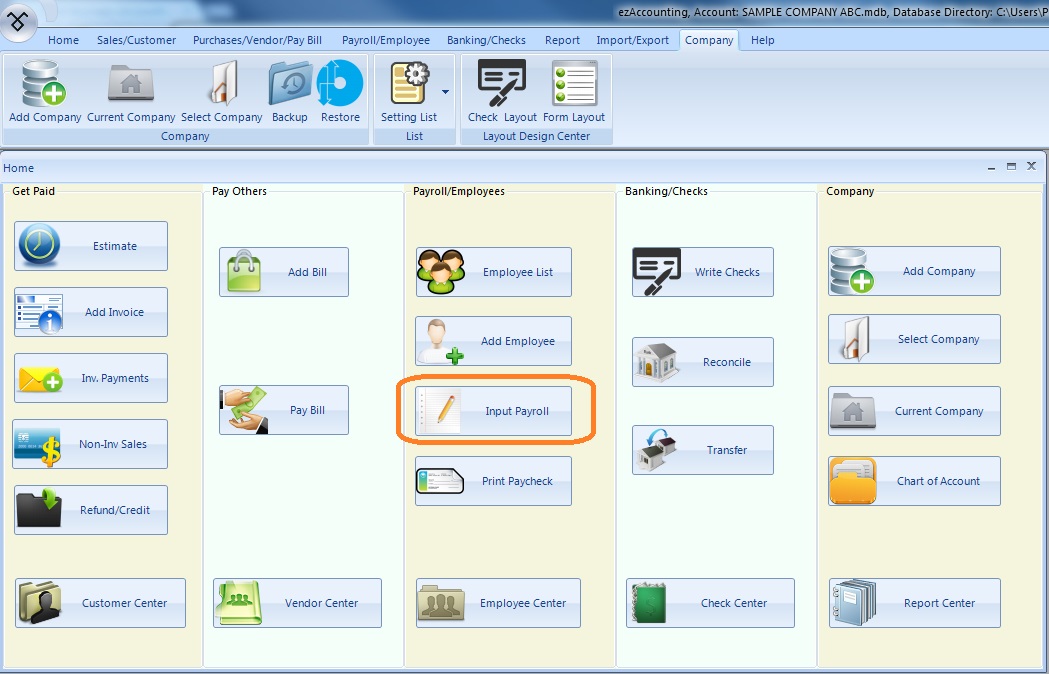

Click to view larger image

Click to view larger image

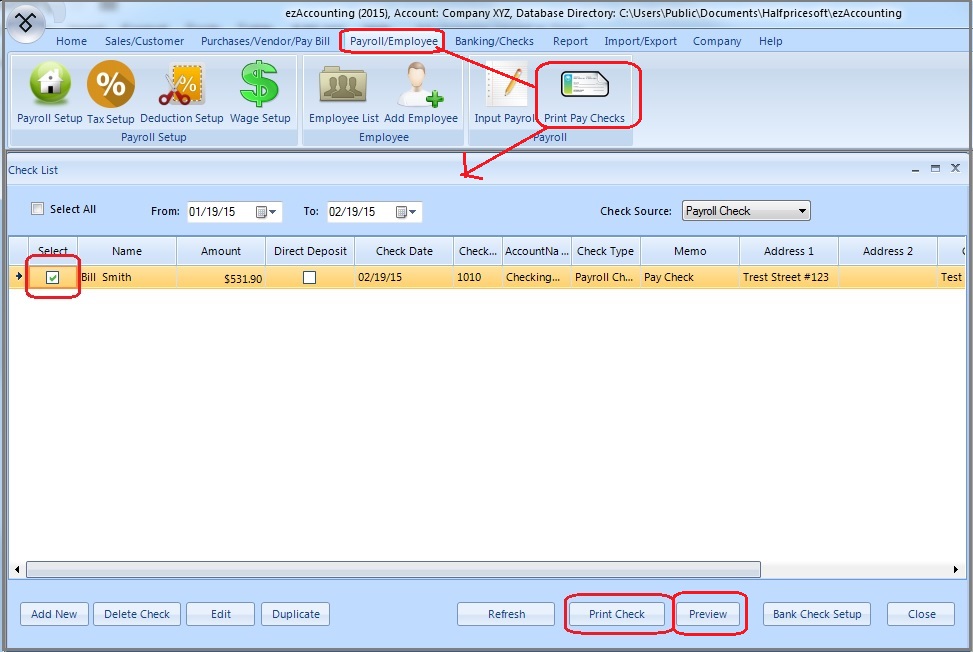

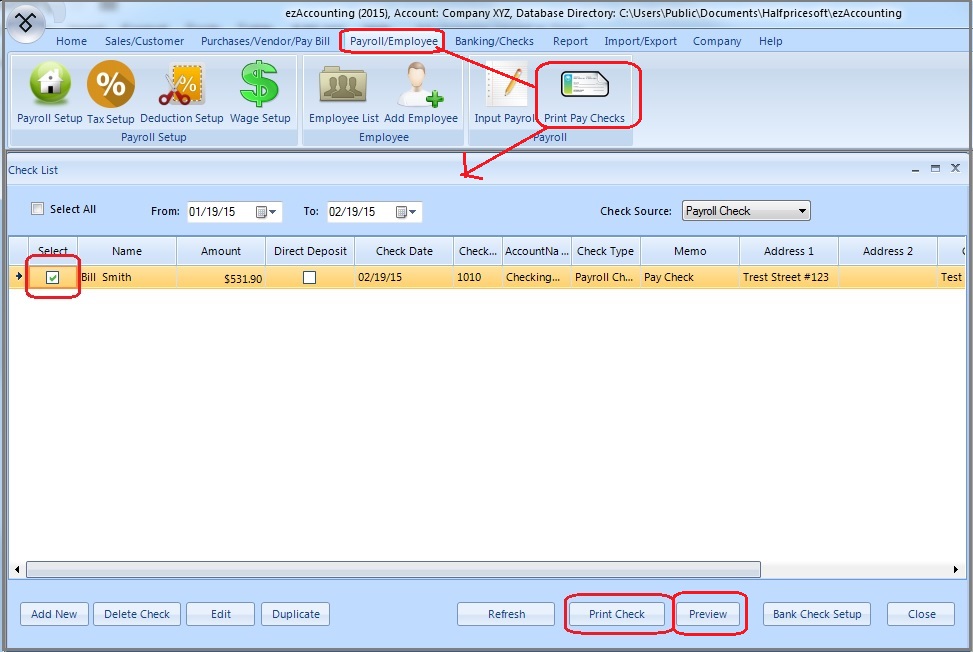

Step 4: Print check

Click to view larger image

(back to top)

Related Topics