ezAccounting Software Guide: Payroll Processing

Part 5: Management Employess and Paychecks

<

Previous Step: Bank Accounts and Checks Next Step: Report Center >

ezAccounting software comes with payroll features. Designed with simplicity in mind, ezAccounting payroll software speeds up payroll tax calculations, paycheck printing and tax form reporting.

1: Set up Company Information 2: Checking Account Set up 3: Add and Edit Employees 4: (Optional) Switch to ezAccounting payroll in mid year - enter YTD manually 5: Add and Print Paychecks After the fact payroll Payroll FAQs Settings related to payroll

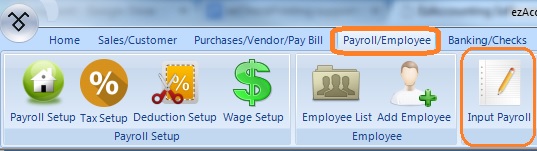

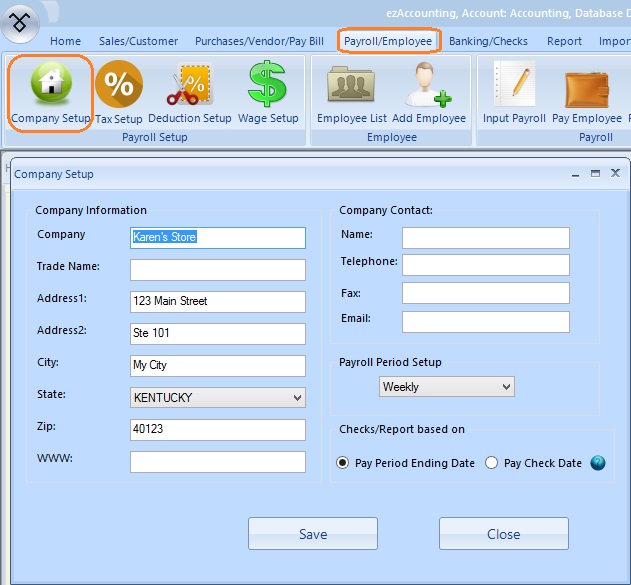

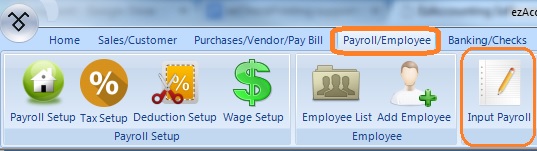

You can access payroll functions by clicking the top menu "Payroll/Employee".

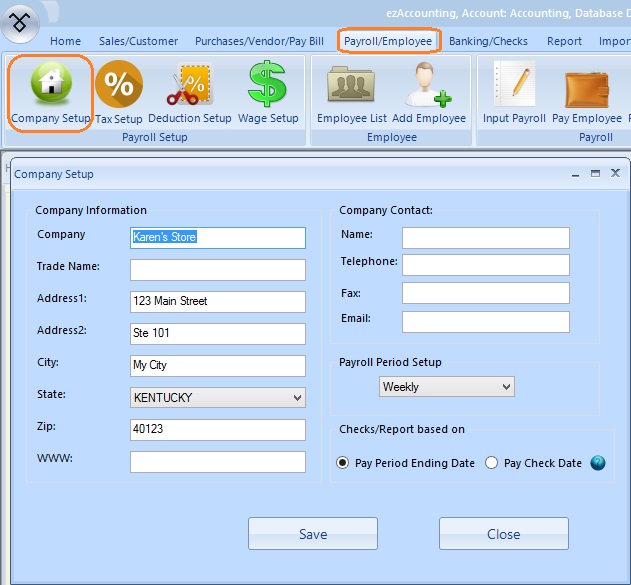

Step 1: Set up Company Information

1.1 Set up company general information here

Click to view bigger image

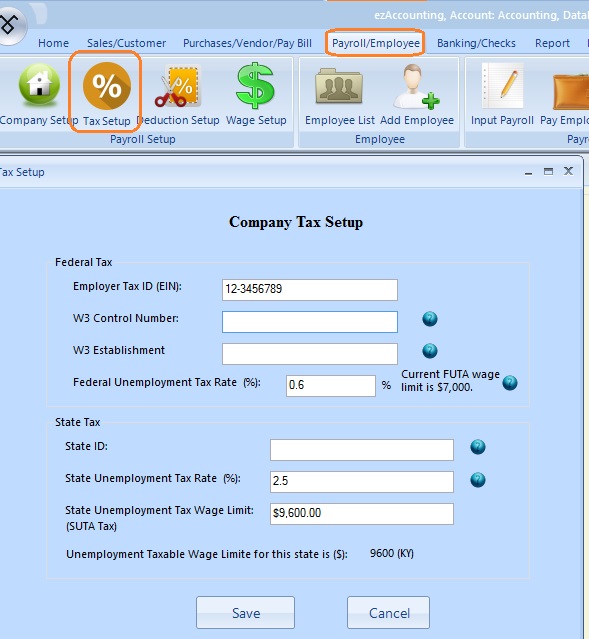

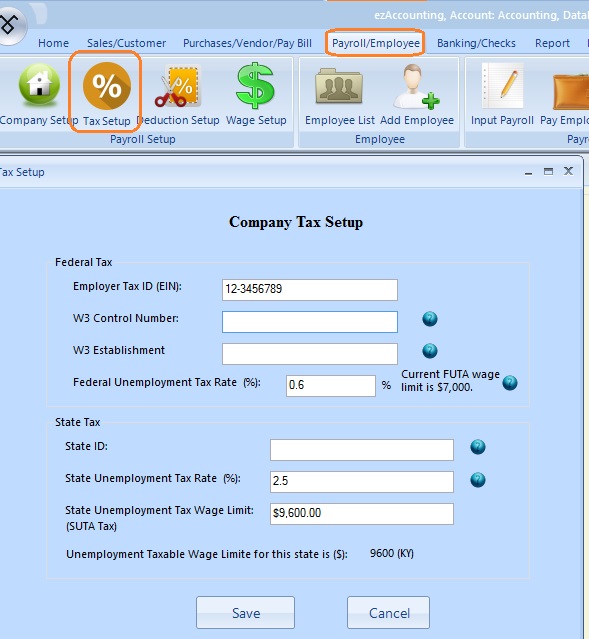

1.2 Set up company tax information option

Click to view bigger image

- company Tax ID

- W3 control number and W3 Establishment number (optional): These two fields will be used for W2 and W3 forms only.

- FUTA (Federal Unemployment Tax): Employer-side tax only and will not be printed on paycheck stubs

The default tax rate for 2013 is 6%. However, many companies can take up to 5.4% credit. Please check with your local IRS office to see what rate you should use.

- SUTA (State Unemployment Tax): Employer-side tax only and will not be printed on paycheck stubs

- Save your changes

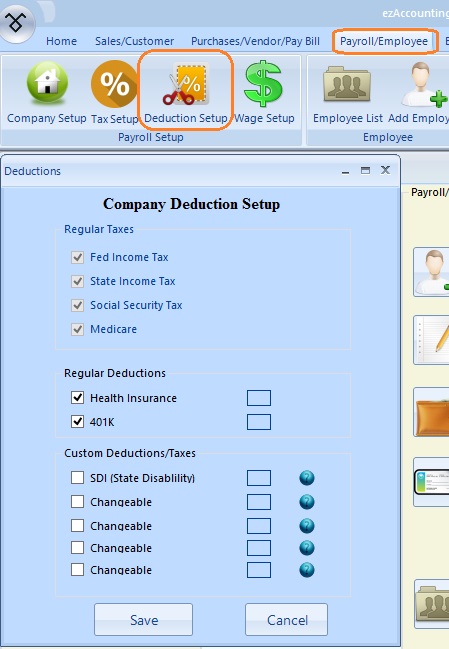

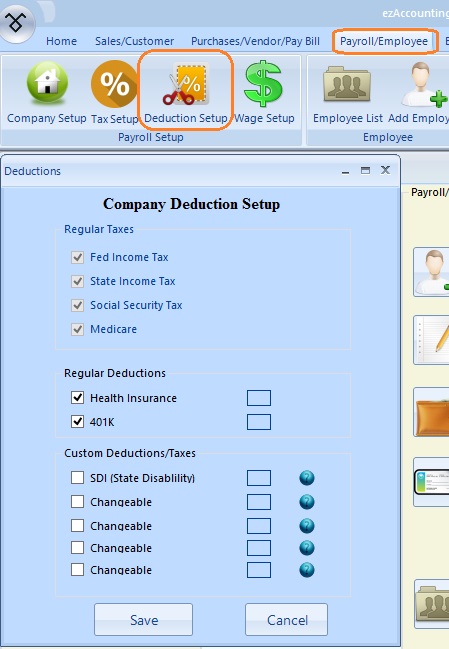

1.3 Set up company deduction options

Click to view bigger image

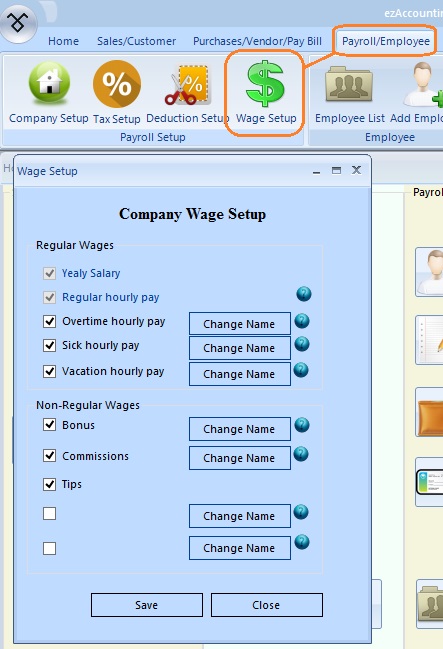

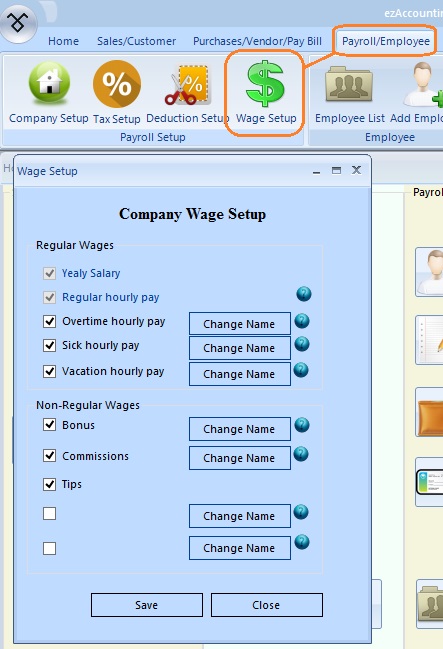

1.4 Set up company Wage options

Click to view bigger image

(back to top)

Step 2: Checking Account Set up

If you have already set up your bank account, you can ignore this step.

If you need to set up checking account, you can refer this guide how to setup checking account(s).

Step 3: Add/Edit Employees

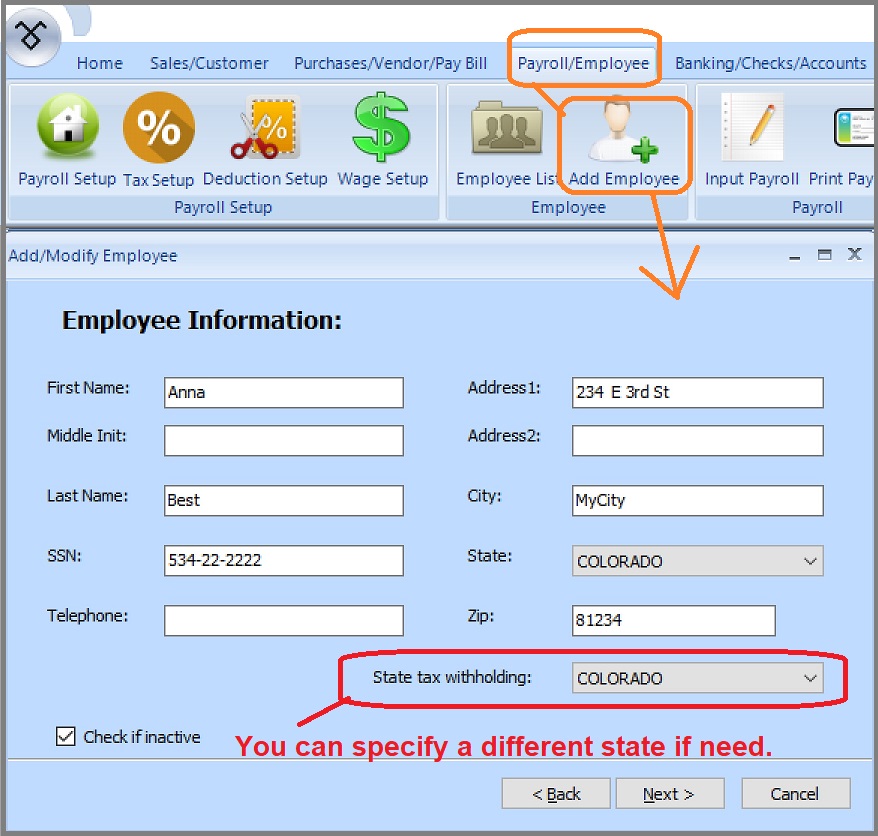

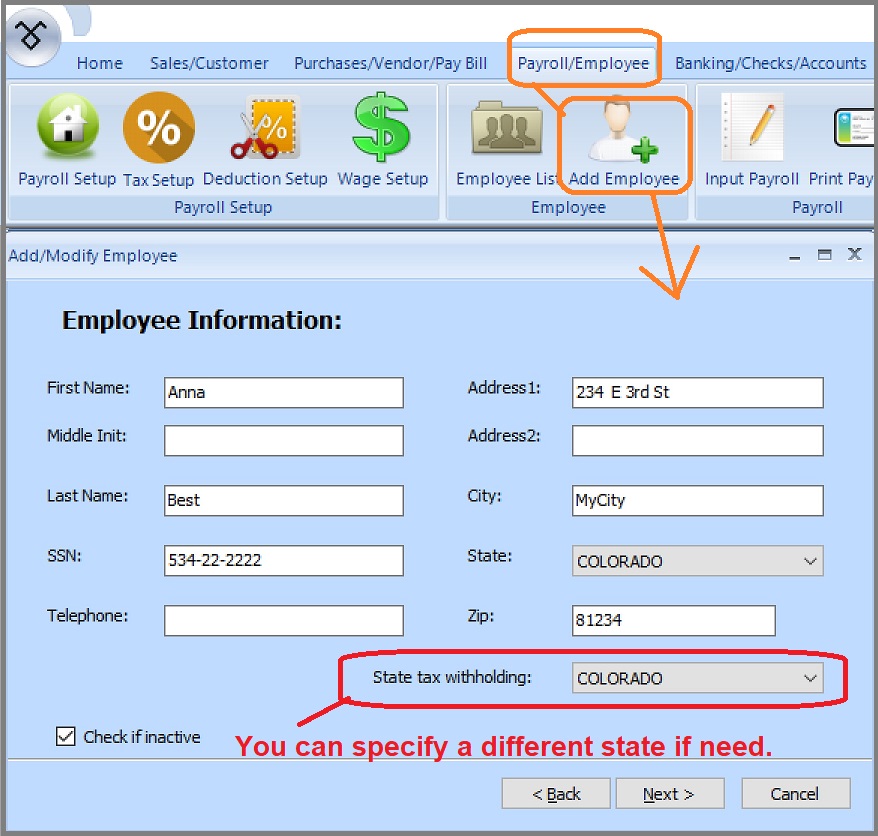

3.1 Add employee general information

(Click image to enlarge)

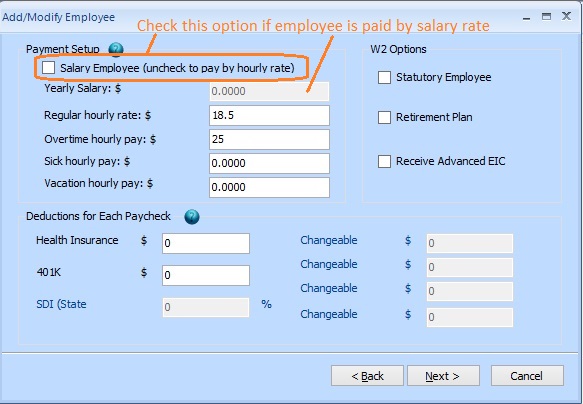

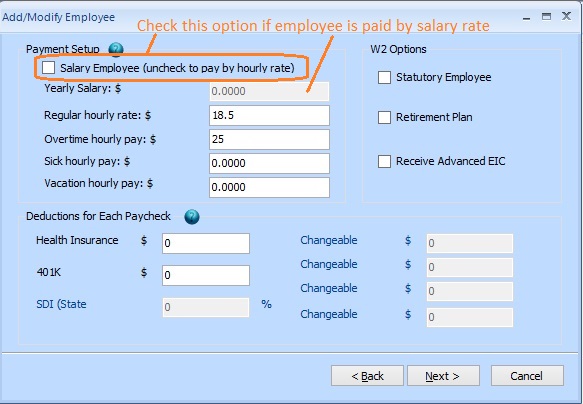

3.2 Employee payment and deductions

- If you set up employee to be paid by salary, then check the option box "Salary Employee" and enter the amount for yearly salary

- If you set up employee to be paid by hourly, then uncheck the option box "Salary Employee", leave Year Salary field as "$0", and enter the hourly rate.

- Set up the deductions for each paycheck.

(Click image to enlarge)

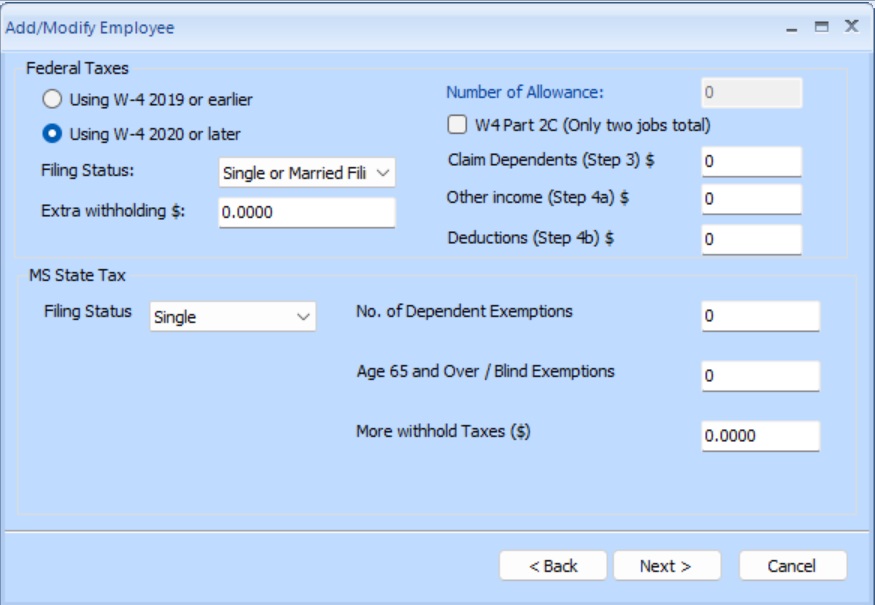

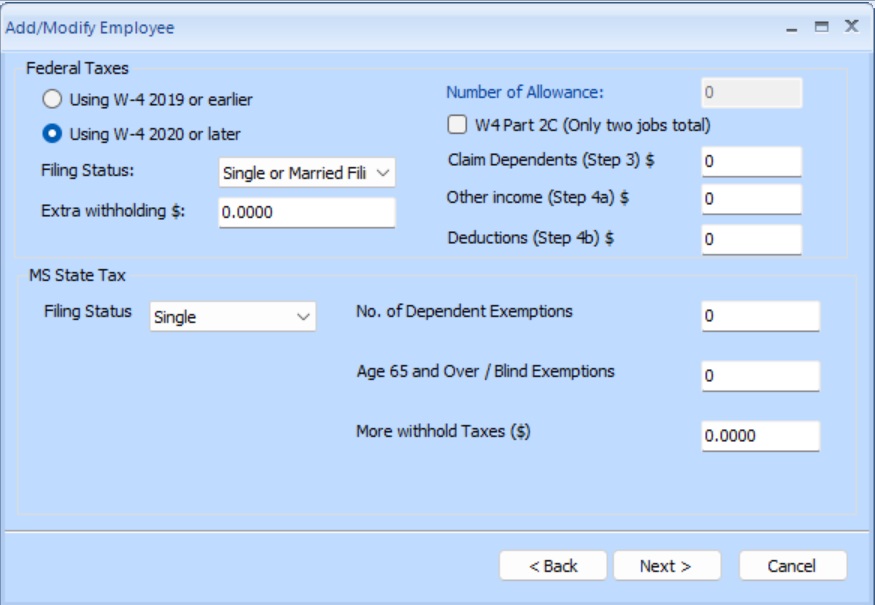

3.3 Employee settings for federal and state taxes

(Click image to enlarge)

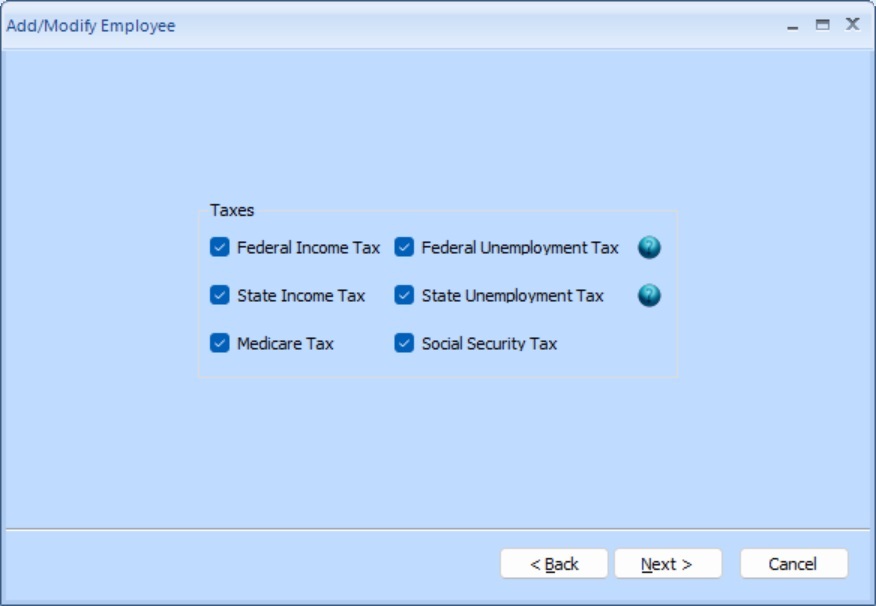

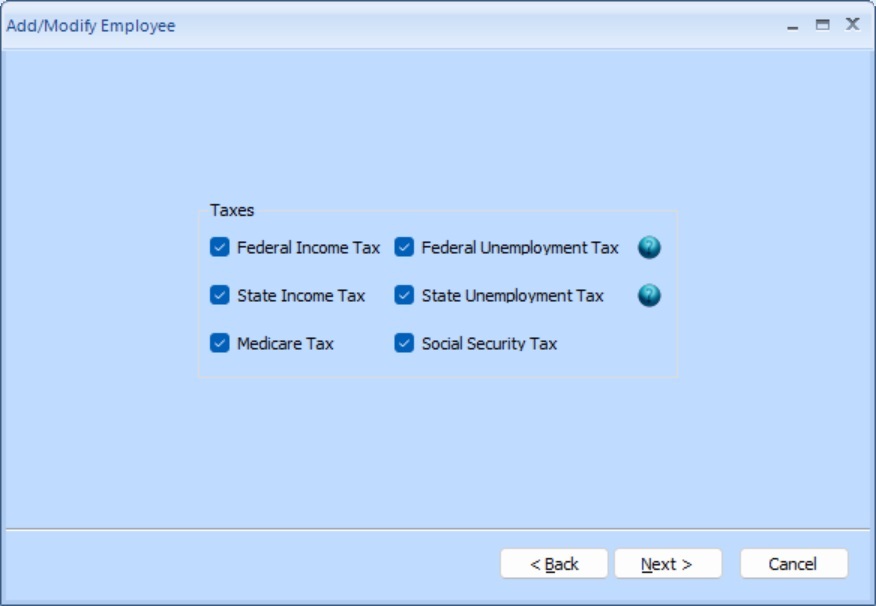

3.4 Edit tax options

Nonprofits and churches that do not need to deduct FICA taxes for clergy members and some employees, can uncheck Social Security tax and Medicare tax here.

(Click image to enlarge)

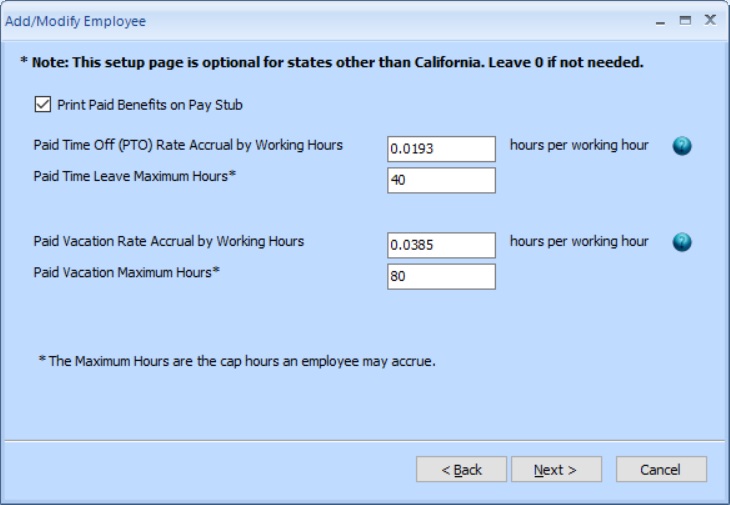

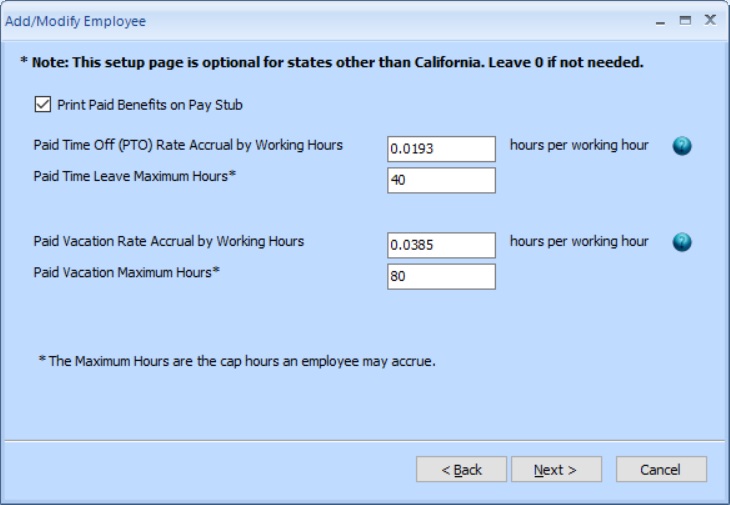

3.5 Employee PTO settings

(Click image to enlarge)

(back to top)

Step 4: (Optional) Switch to ezAccounting payroll in mid year - enter YTD manally

Customers can start to use ezAccounting payroll feature any time in a year. Here is the step by step guide about how to enter YTD data manually if you need to enter previous payroll data.

How to enter YTD manually

Step 5: Add Paychecks and Print Checks

(Click image to enlarge)

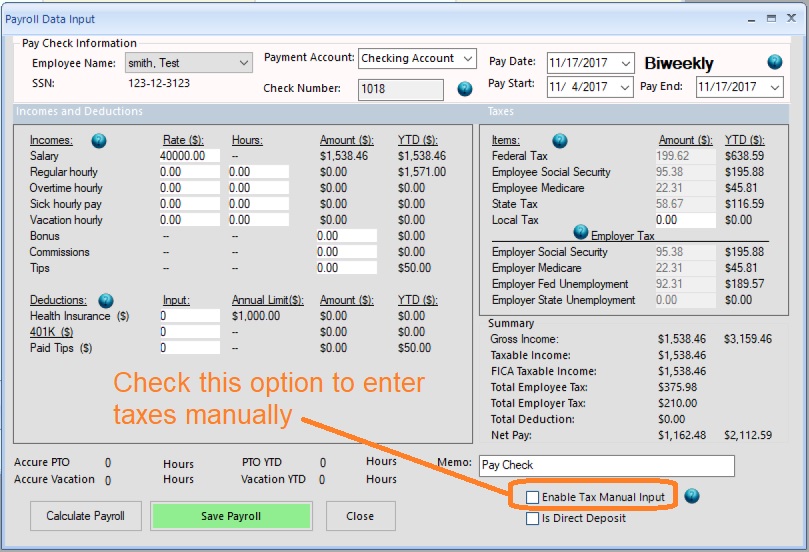

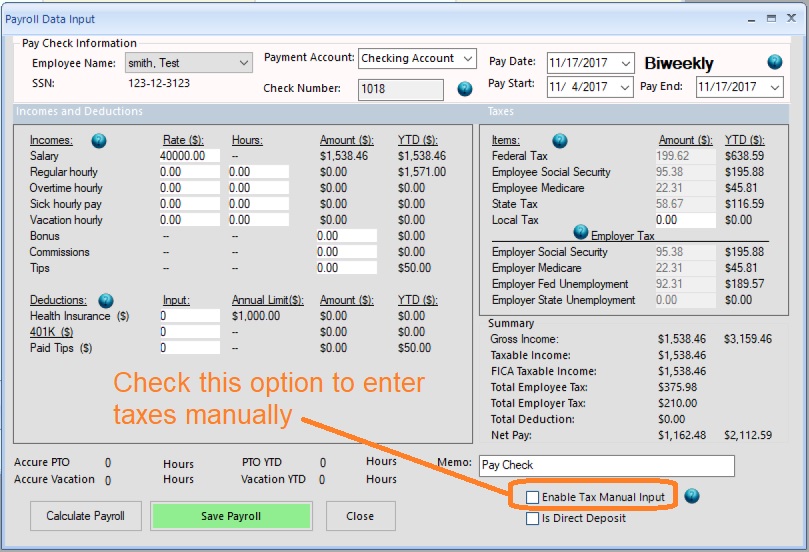

5.1 Add a paycheck by salary rate

On new check screen:

- Select this employee from list

- Specify Pay Date, Pay Start Date and Pay End Date.

- Review the information on screen

- Save this new check.

- Click the CLOSE button to close this screen for other operations (such as adding check for another employee or printing checks)

(Click image to enlarge)

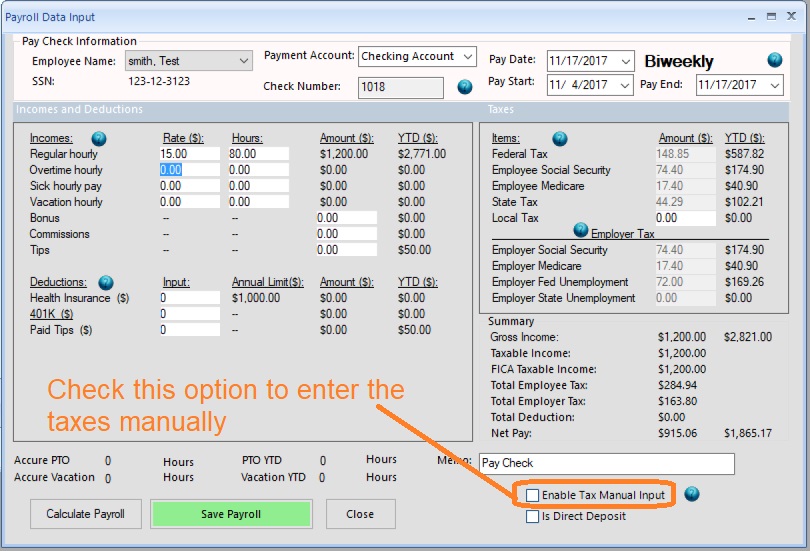

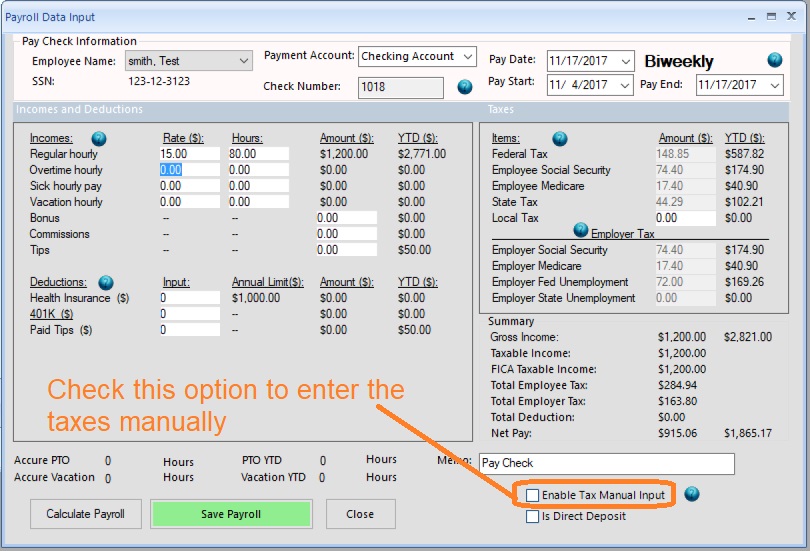

5.2 Add a paycheck by hourly rate

On new check screen:

- Select this employee from list

- Specify Pay Date, Pay Start Date and Pay End Date.

- Enter hours - Review the information on screen

- Save this new check.

- Click the CLOSE button to close this screen for other operations (such as adding check for another employee or printing checks)

(Click image to enlarge)

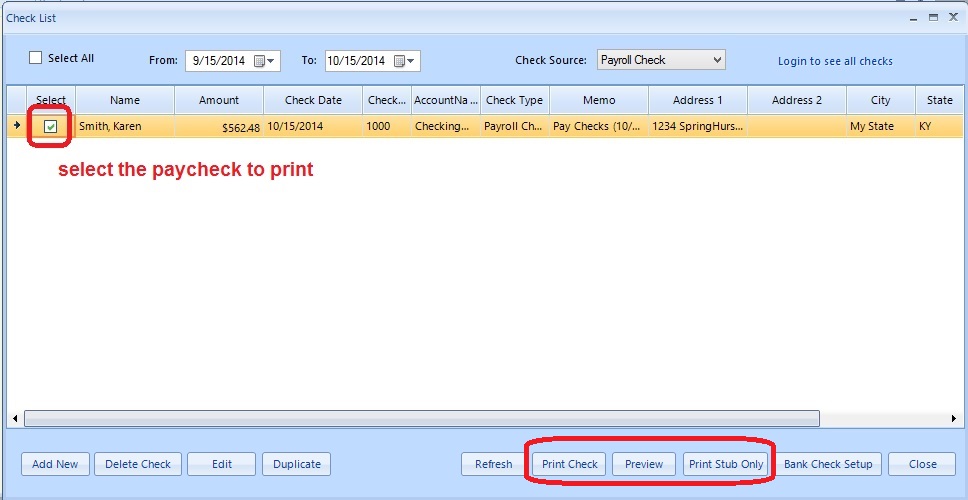

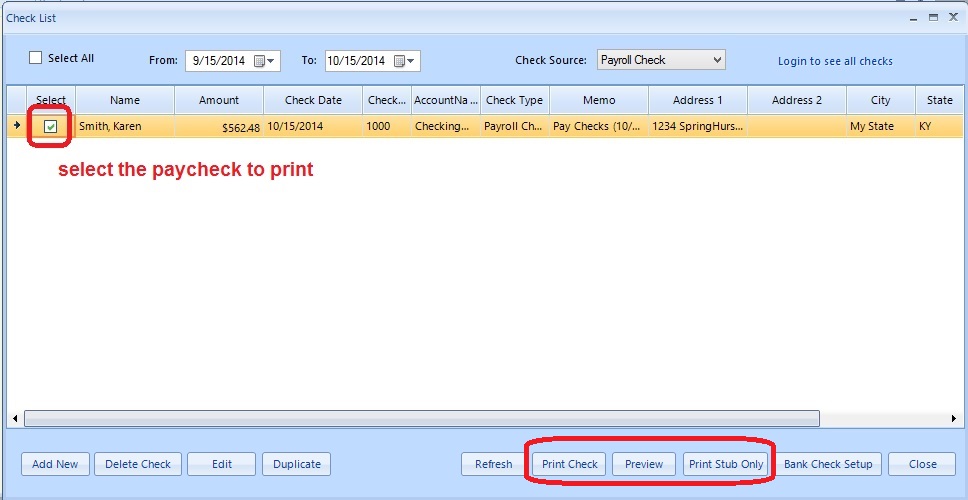

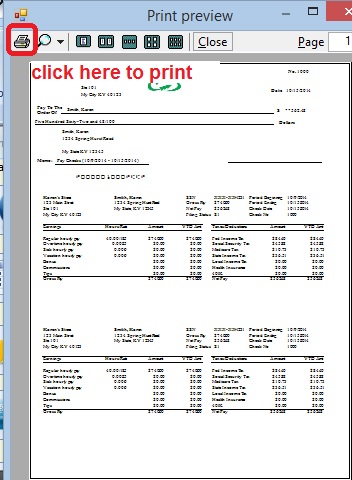

5.3 Print Paychecks

You can select multiple paychecks from list and click the Print button to print paychecks together.

(Click image to enlarge)

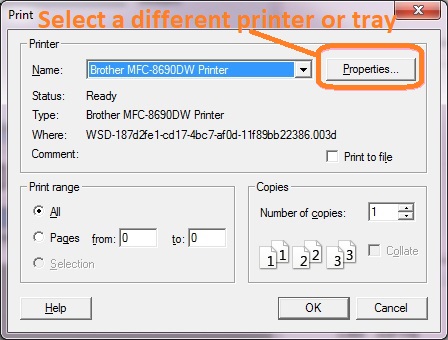

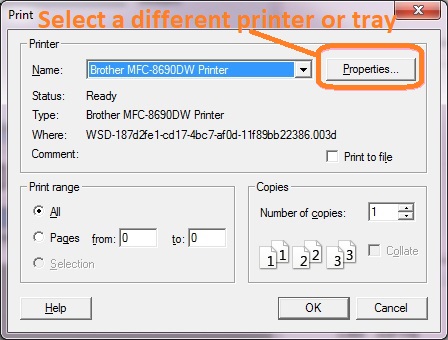

5.4 Select a printer

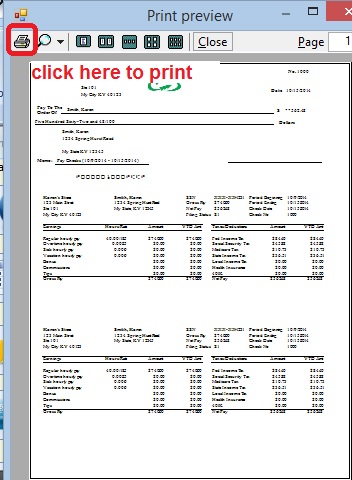

5.5 Print or print preview check

- If you click the "Print" button, the check will be printed on paper directly.

- If you click the "Preview" button, you can preview check(s) on screen and click the printer icon to print it on paper.

(Click image to enlarge)

< Previous Step: Bank Accounts and Checks Next Step: Report Center >

Need more information about how to pay employees

More information

about payroll can be found from FAQs.

(

back to top)

Related Topics