ezPaycheck Troubleshooting: Form W2

Download Now >

Buy Now > ezPaycheck payroll software makes it easy to calculate taxes and file tax reports.

| W2 Form issue | Solution |

| My ezPaycheck is with last year's W2 Form | View solution #1 |

| No data in Form W2 | View solution #2 |

| Form W2 data is not correct because it does not match my manual calculation | View solution #3 |

#1: My ezPaycheck is with last year's W2 form

1.1. IRS releases new year-end Form W2 in November or December each year. We will update ezPaycheck when the new form is available.

1.2. If you see this issue at the end of of December, you can

update ezPaycheck to get the latest form.

#2: No data in Form W2

2.1. Please make sure the W2 form is with correct year information. 2.2. Please make sure you paid that employee in that year.

#3: Wrong data in Form W2

3.1 Please make sure you selected the correct report option.

ezPaycheck generates the paychecks and reports by pay period ending date by default. You can change this option if your company uses pay check date.

How to change report option https://www.halfpricesoft.com/payroll-software/payroll-report-date-change.asp

For example: Paycheck #30001, for pay period 12/16/ to 12/31/ paid on 1/2/2025

If you select to generate the report by Pay period Ending Date, paycheck #30001 is the last check of year and will be displayed on Year report.

If you select to generate the report by Pay Date, paycheck #30001 is the first check of year 2025 and will be displayed on Year 2025 report.

3.2 Please view "Employee Payroll Detail Report" to verify the data

- Click ezPaycheck left menu "Forms and Reports", then the sub menu "Reports" to view the report options.

- Select "Employee Payroll Detail Report"

- Select the employee from list

- Select the correct date range from Jan 1 to Dec 31.

- Click the "Display" button to view the check list and summary data.

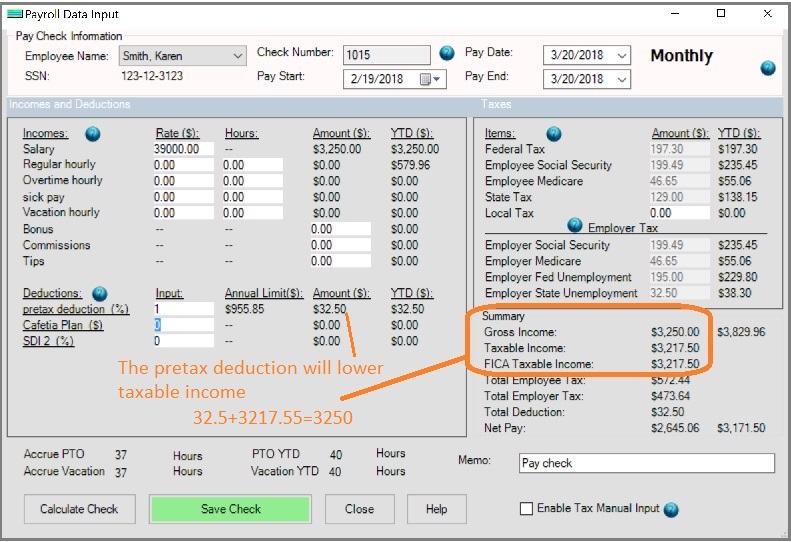

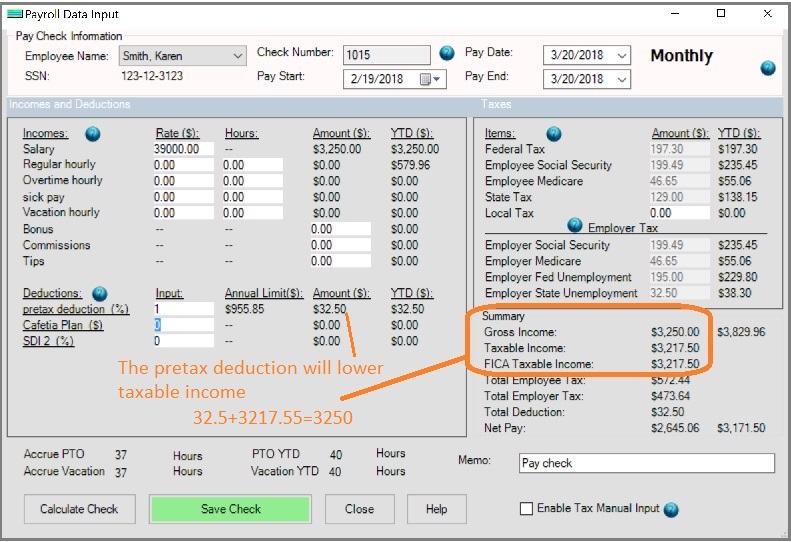

You will see this gross payment in employee report. You will see taxable payment in Form W2 report. If your employees have the protax deducation(s), the taxable income will be lower than the gross income.

3.3 Please check if you have any pre-tax deduction.

When you generate a paycheck, you can view the summary part. If the

Taxable Income is lower than the

Gross Income, that means you set up some deduction that is exempt from federal and state taxes.

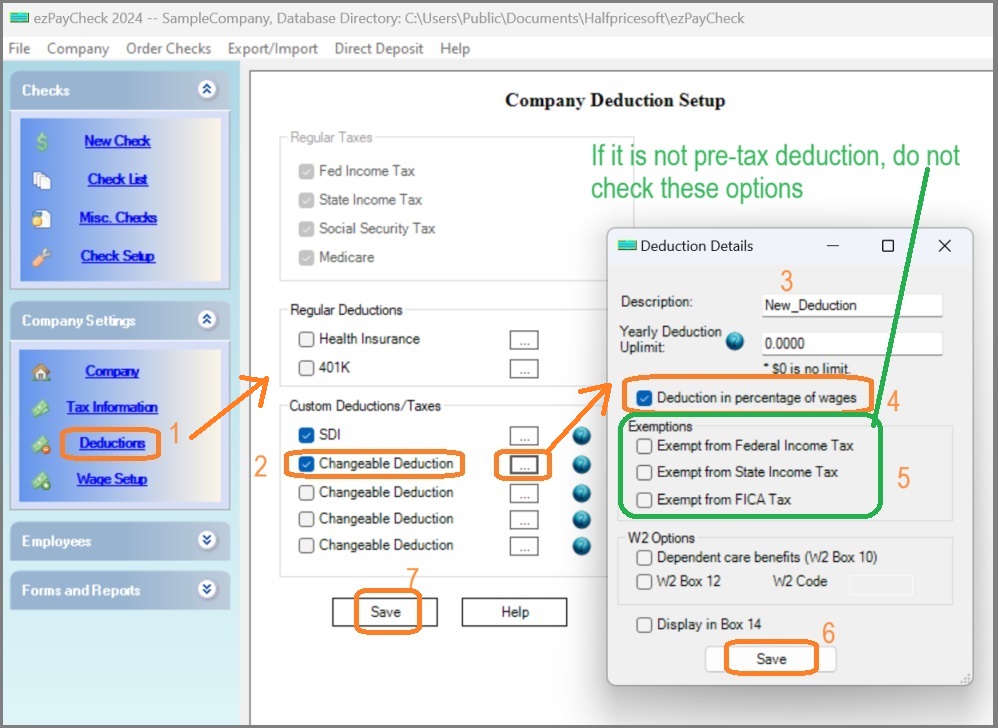

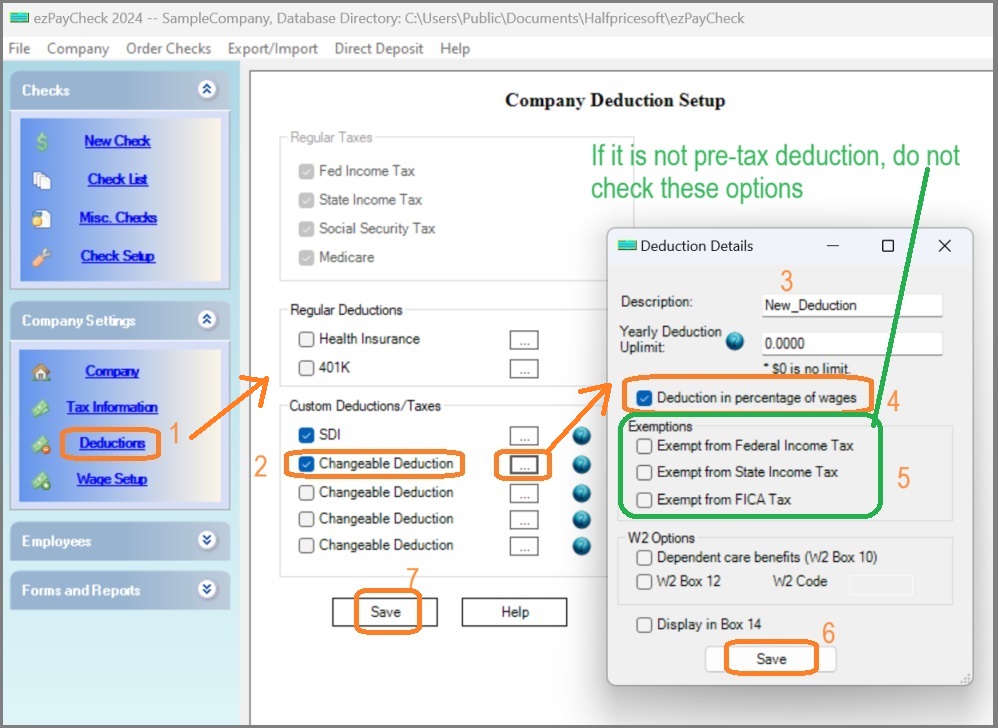

Solution:

Solution:You can review each dedution details. If the deduction is set up to be exempt from federal and state tax by mistake, please change the option. After you delete the wrong paycheck, you add new paycheck. You will see the correc federal and state tax amount.

Related Links:

Why the social security tax is not correct Why the state income tax is not correct