How to Calculate 2018 Federal Income Withhold Manually

ezPaycheck payroll software speeds up and simplifies payroll tax calculation, paycheck printing and tax reporting for small businesses. However if you like to calculate the taxes manually, you can find the step by step guide below.

Example: Karen is married, with 1 allowance. Her salary rate is $39000. She receives one paycheck each month. .

1. Her gross income for each paycheck is $3250

39000/12=$3250

2. Her standard deduction for each paycheck is $337.5

Year 2018 Standard Deduction is $4,150.00

For each paycheck: 4150/12=$345.83

3. Her taxable income for each paycheck is:

3250-345.83=

$2904.17 4. Federal tax

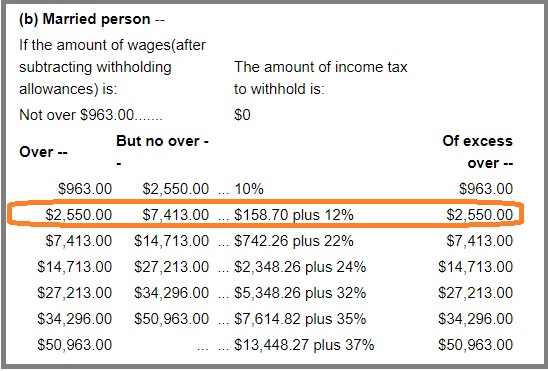

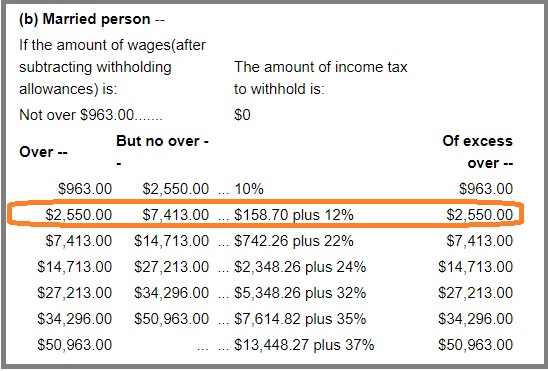

Check Monthly tax table for married person

https://www.halfpricesoft.com/federal_income_tax_2018.asp

158.70 + 12% x (2904.17-2,550.00)=

$201.20

Related Links:

Download Now >

Buy Now >