ezPaycheck Payroll: How to Withhold Extra Federal And State Income Taxes from Employee Paychecks

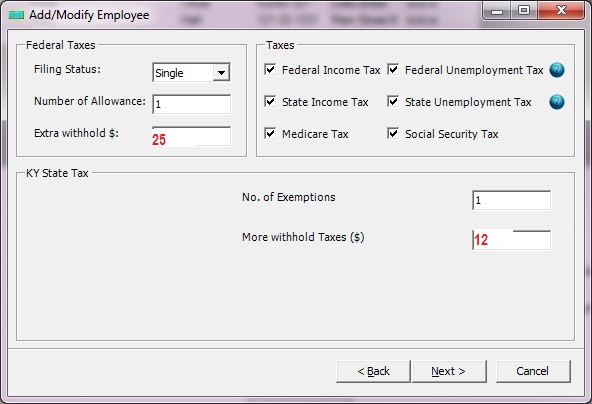

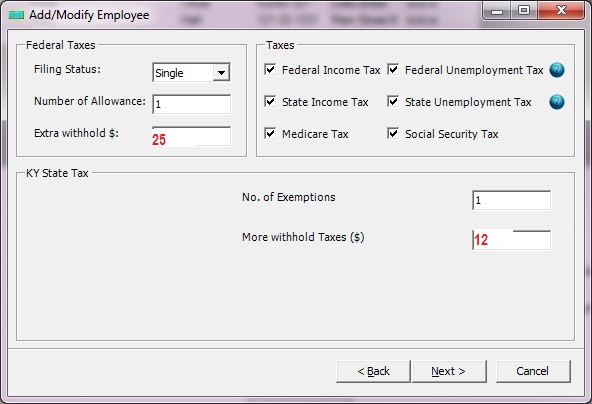

1. Open employee set up screen and enter the extra taxes

ezPaycheck payroll software can calculate federal, state and local tax automatically based on employee profile setup. When you set up employee profile, you can specify the extra federal tax and extra state tax to withhold if needed. (If no additional withholding is needed, leave it as zero.)

(Click image to enlarge)

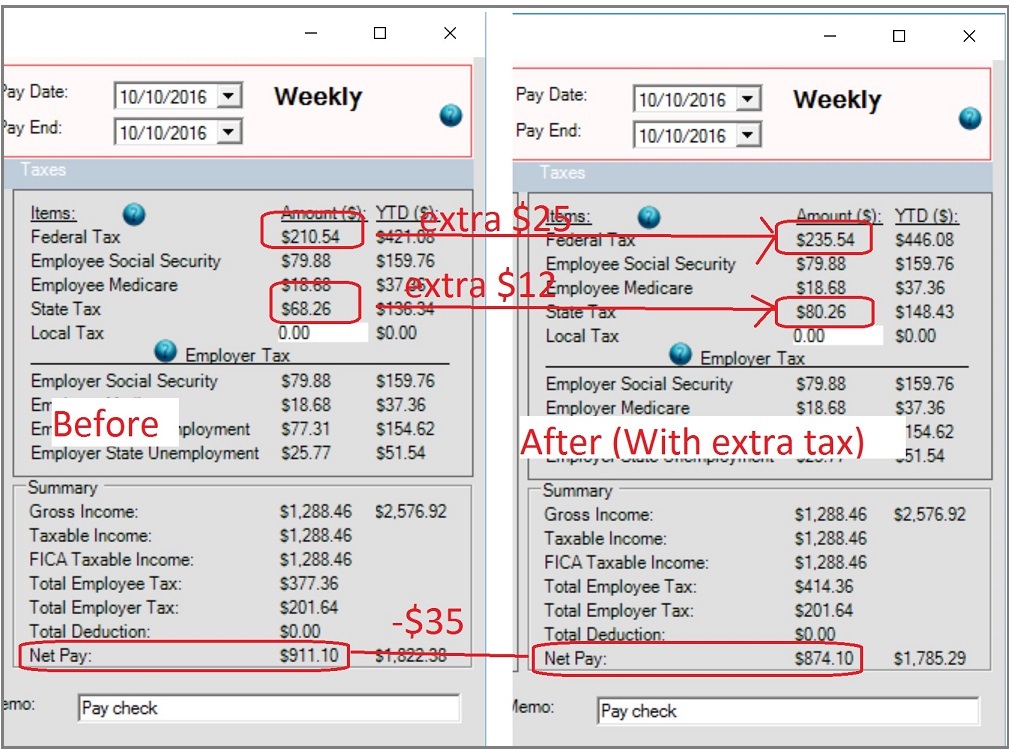

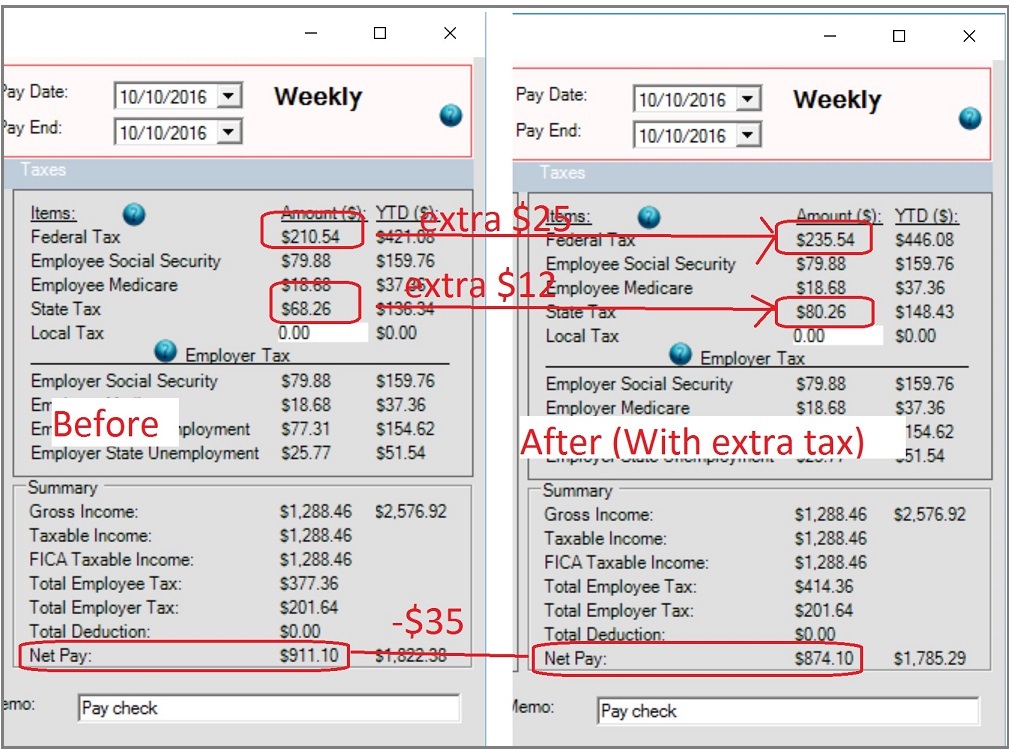

2. Add and print the paychecks

You can view the two paychecks to see the difference.

(Click image to enlarge)

Note: Manual Check Feature

If you just need to withhold extra taxes from one paycheck, it will be easier to use the

manual check feature to enter the taxes manually.

Related Links:

Download Now >

Buy Now >