How to Withhold Occupational Tax from Each Paycheck Automatically

ezPaycheck payroll software makes small business payroll an easy job. It includes multiple customized deduction/tax fields to support 401k deduction, health insurance deduction, local tax, occupational tax and more.

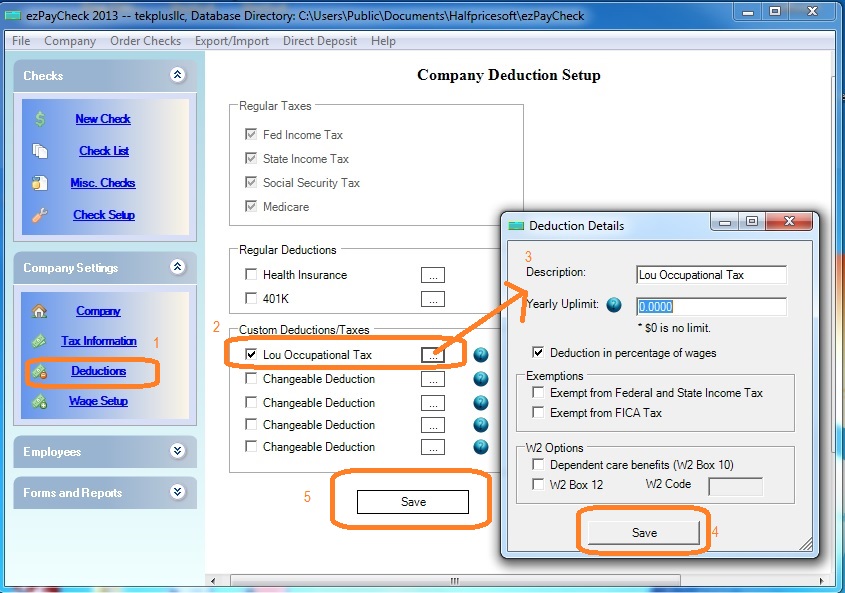

Step 1: Start ezPaycheck and open company deductions set up screen

Step 2: Add a new deduction for Occupational Tax

Check one changeable deduction field

Click button behind it to enter the details. You can set up this deduction by amount or by percent.

Save your changes on each step.

(Click image to enlarge)

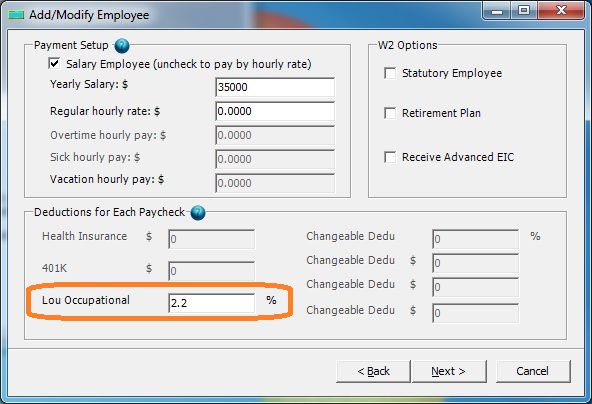

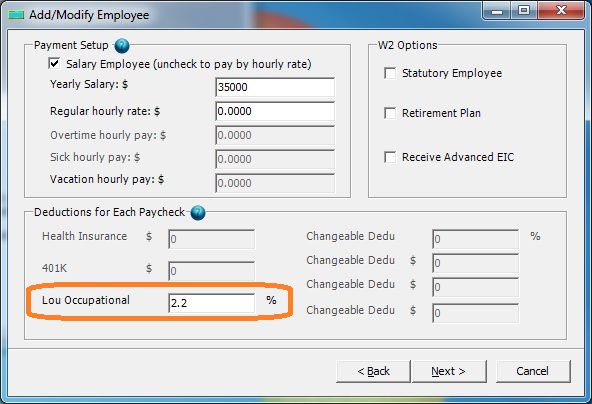

Step 3: Edit employee profile and enter the withhold amount or percent for Occupational Tax

(Click image to enlarge)

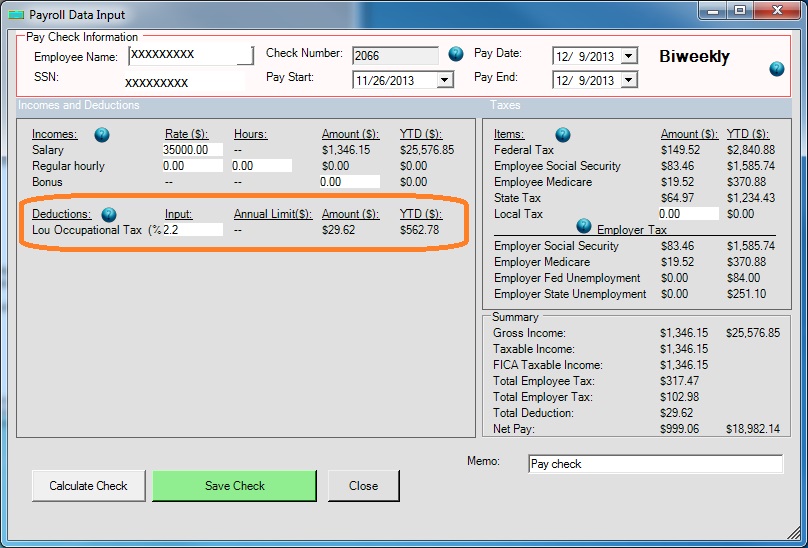

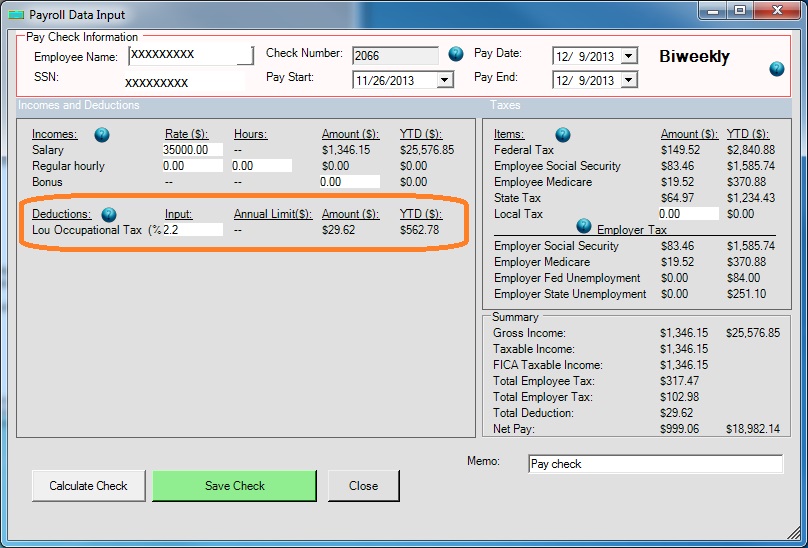

Step 4: Add a new check

You will see the new occupational deduction on the new check. If needed, you can modify the value when you add a new check.

(Click image to enlarge)

Related Links:

Download Now >

Buy Now >