How to Withhold CO FAMLI(Colorado Family and Medical Leave Insurance)?

ezPaycheck payroll software is very flexible. With ezPaycheck, you can withhold CO FAMLI, Colorado Family and Medical Leave Insurance, from each employee paycheck easily.

#1 What is Colorado Family and Medical Leave Insurance(CO FAMLI)

CO FAMLI: On Nov. 3, 2020, Colorado voters approved a measure to create a Paid Family & Medical Leave program. Contributions to the program will begin January 1, 2023 with benefits payable in 2024.

#2 What is the rate?

Please visit CO state page for the latest rate!

Employers and their employees are both responsible for funding the FAMLI program and may split the cost 50/50. The premiums are set to 0.9% of the employee's wage, with 0.45% paid by the employer and 0.45% paid by the employee. Employers may also choose to pay the full amount if they would like to offer this as an added perk for their employees.

Premiums are paid on wages up to the Federal Social Security Wage Cap which is $160,200 for earnings in 2023.

Source: https://famli.colorado.gov/individuals-and-families/premium-and-benefits-calculator #3 How to Withhold CO FAMLI from Employee Paychecks

Step 1. Set up FAMLI deduction

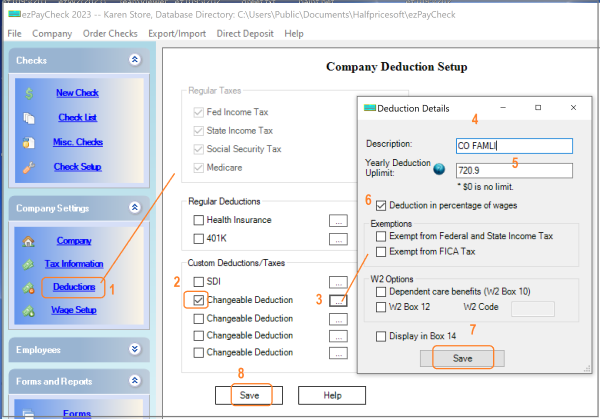

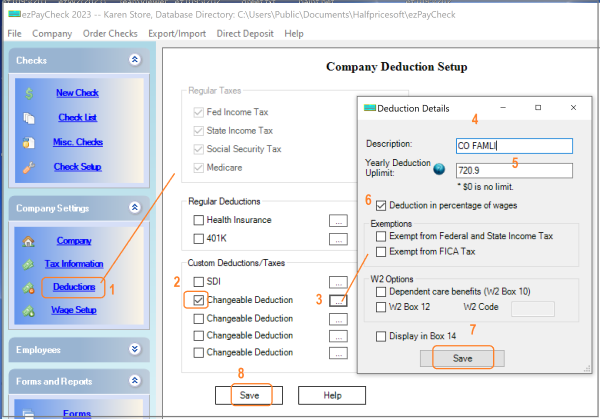

1.1 Start ezPaycheck, click the left menu "Company Settings->Deductions" to open the

Company Deduction Setup screen.

1.2 Check one changeable deduction item, then clicked the button behind it to open the

Deduction Details screen.

1.3. Input the name (ie: "CO FAMLI" or "FAMLI" or others)

1.4. Enter Yearly Uplimit (the maximum to withhold for each employee in a year)

1.5. Check the "Deduction in percentage of wage" option box.

1.6. Click the "Save" button on

Deduction Details screen.

1.7. Click the "Save" button on

Company Deduction Setup screen to update the database.

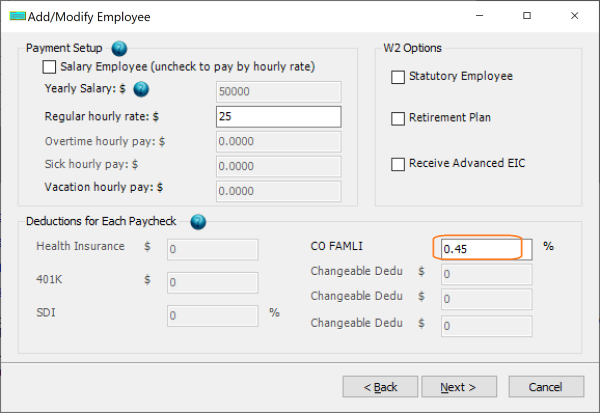

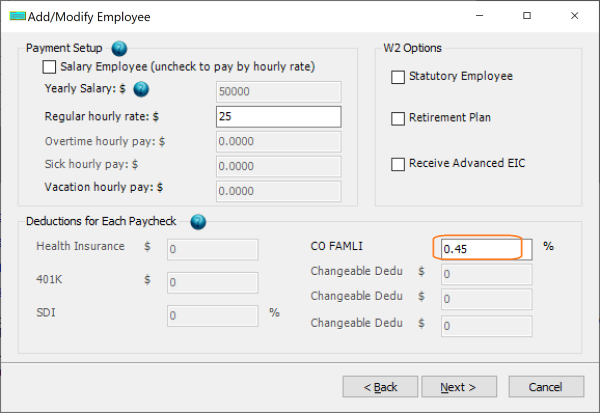

Step 2. Edit employee settings to specify the rate of the new deduction

2.1. Select one employee from employee list and edit the deduction option.

2.2. Enter the percent value.

2.3. Click the "Next" button until the last page, then click the "Finish" button to save the change.

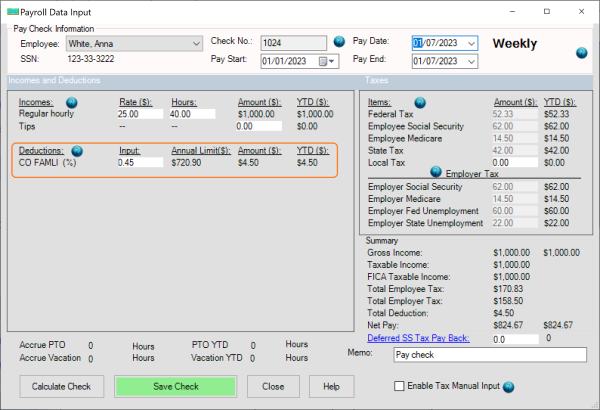

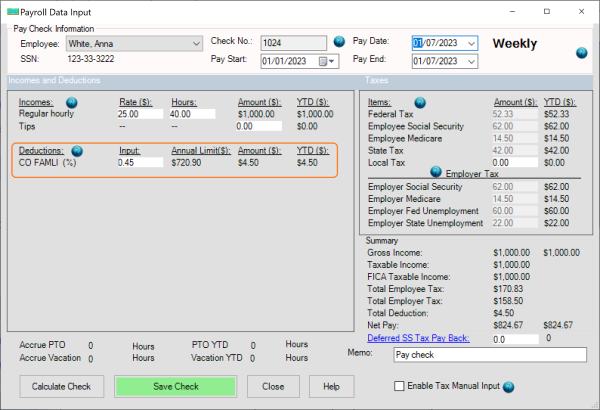

Step 3. Generate a new check

When you generate the new check, you will see this new "CO FAMLI" deduction on paycheck.

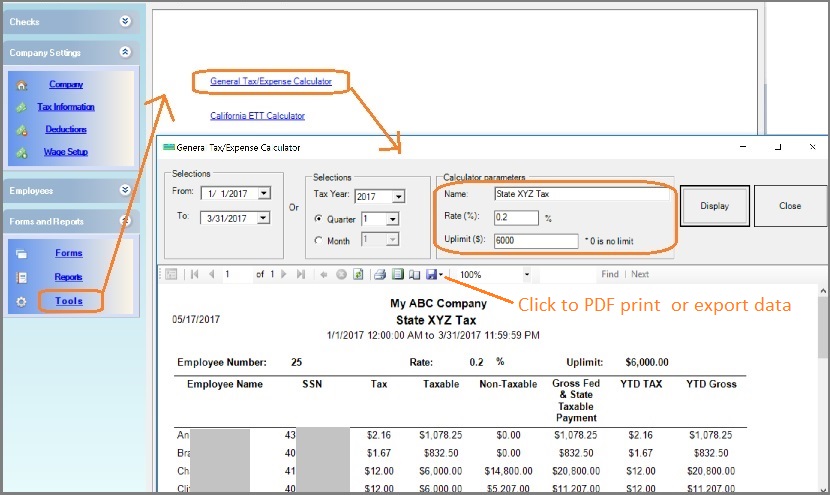

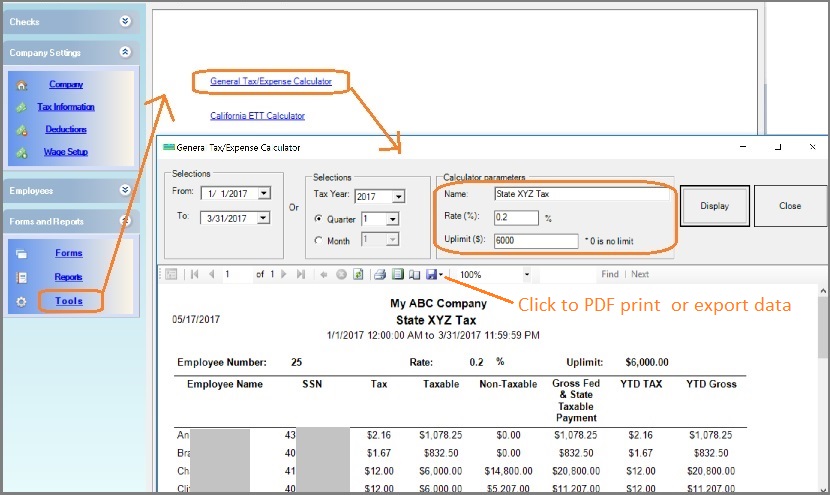

#4 Employer side Contributions

Clients can use the payroll tools to calculate employer side contributions.

Troubleshooting

Why the social security tax is not correct Why the federal income tax is not correct Why the state income tax is not correct

Related Topics