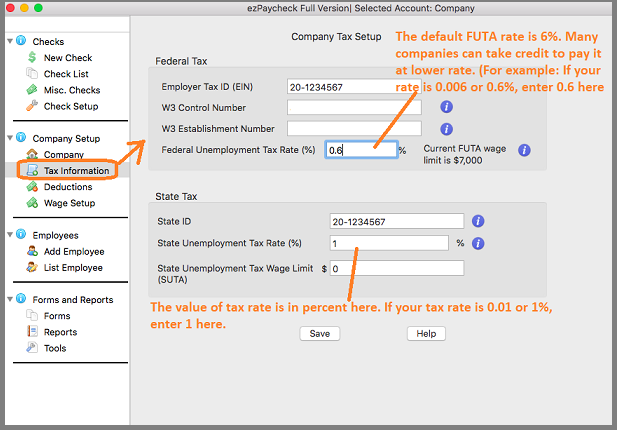

You can click the left menu "Company Settings" then click the sub menu "Tax Information" to open the company tax setup screen

(Click image to enlarge)

- company Tax ID

- W3 control number and W3 Establishment number (optional): These two fields will be used for W2 and W3 forms only.

- FUTA (Federal Unemployment Tax):

employer-side tax only and will not print on paycheck stubs

The default tax rate for 2019 is 6%. However, many companies can take up to 5.4% credit. Please check with your local IRS office to see what rate you should use.

- SUTA (State Unemployment Tax):

employer-side tax only and will not print on paycheck stubs

- Click the

UPDATE button to save your changes