Payroll Solution: How to Calculate State Income Tax

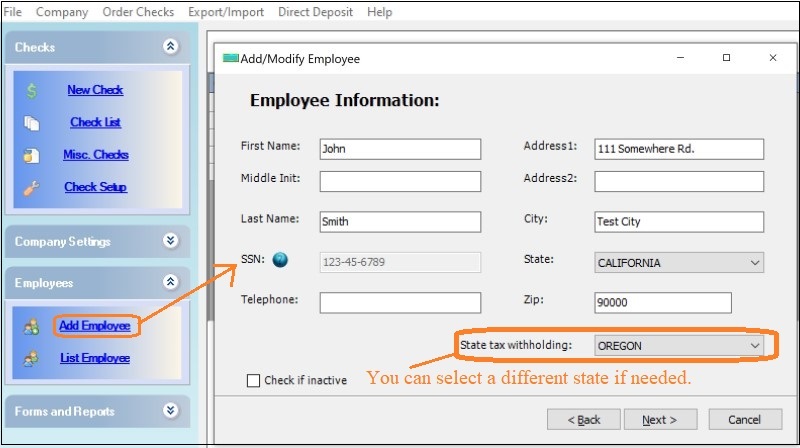

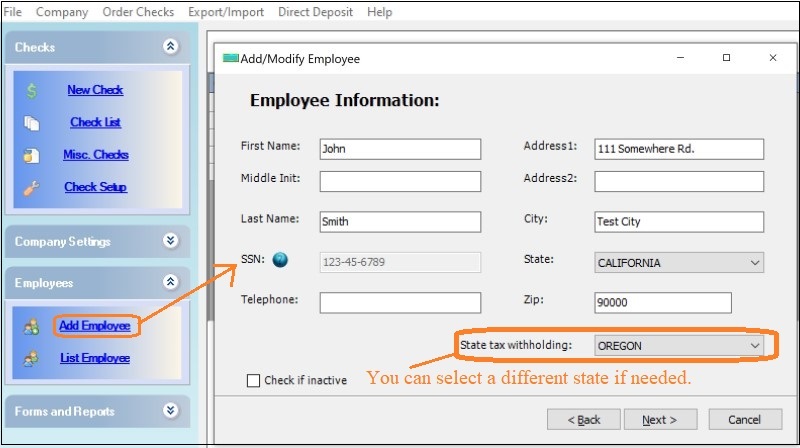

ezPaycheck payroll software is the easy-to-use and flexible payroll tax solution for small businesses. You can specify the state tax option when you set up an employee.

1. Download and install the right version to calculate your paychecks

ezPaycheck 2025 comes with Year 2025 federal and state tax tables. ezPaycheck comes with Year federal and state tax tables. You should use the right version of ezPaycheck paryoll software.

If you are a new customer, you are welcome to download and test drive ezPaycheck for 30 days free with no obligation. No credit is needed. No registration is needed. 2. Specify the employee state tax option

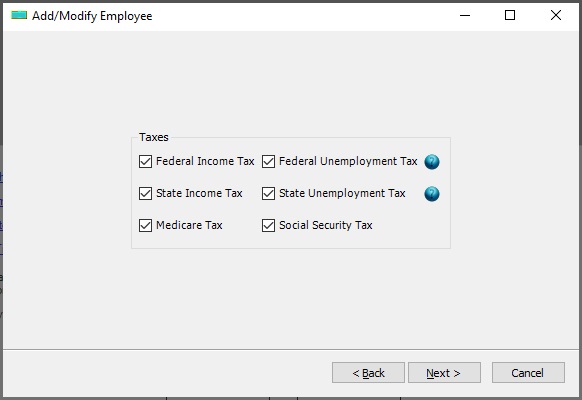

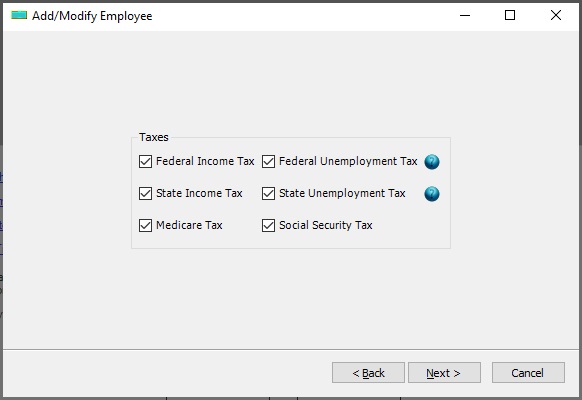

When you set up employee profile, please make sure you check state tax option. (This option is checked by default.)

If you have any questions about how to set up employee, you can refer to

ezPaycheck Payroll Software Quick Start Guide.

(Click image to enlarge)

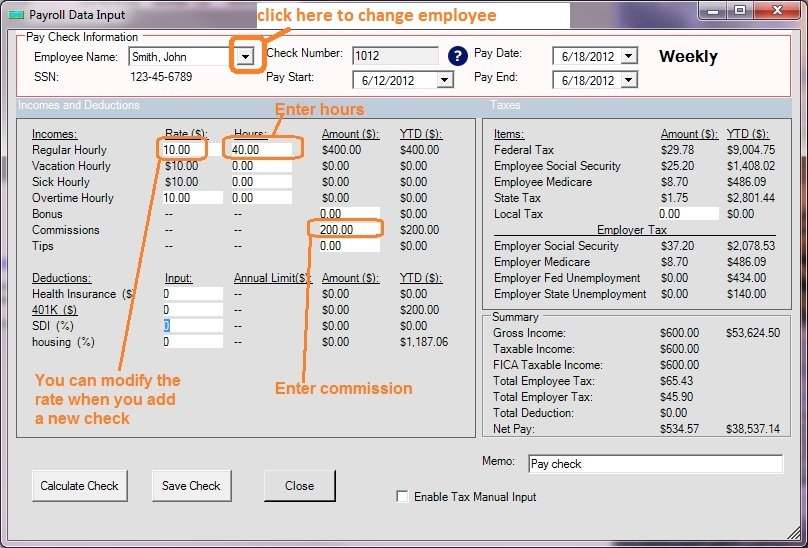

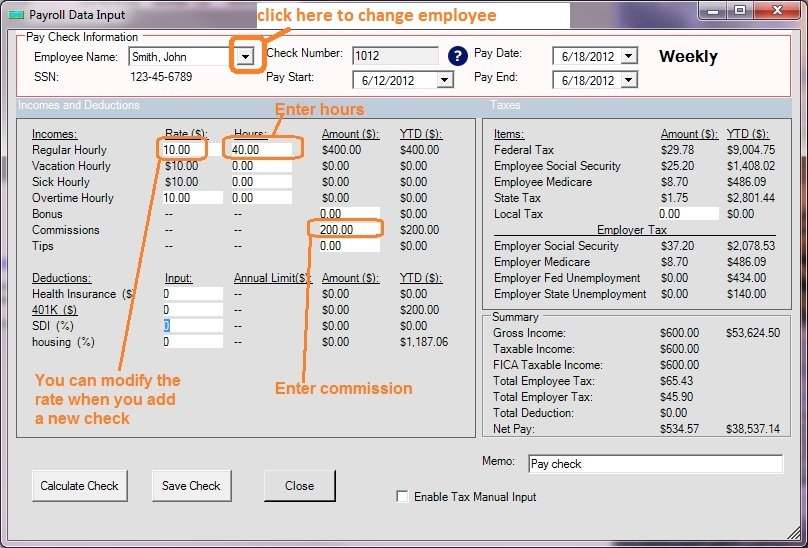

4. ezPaycheck will calculate the federal and state income tax withholding automatically

5. More Information

Why the state income tax is not correct Why the federal income tax is not correct Why the social security tax is not correct How to print paystub into PDF file Sample Paychecks

Related Links: