ezPaycheck: How to add a new payroll deduction and withhold it from each paycheck automatically

ezPaycheck payroll software is very flexible. With ezPaycheck, user can easily add a new deduction to handle IRA plan, insurance, garnishment, donation, dependent care, flexible account, local taxes or more. Here are the steps on how to add a new payroll deduction:

Option 1: By percent deduction Option 2: By amount deduction Option 1: How to add a by percent deduction

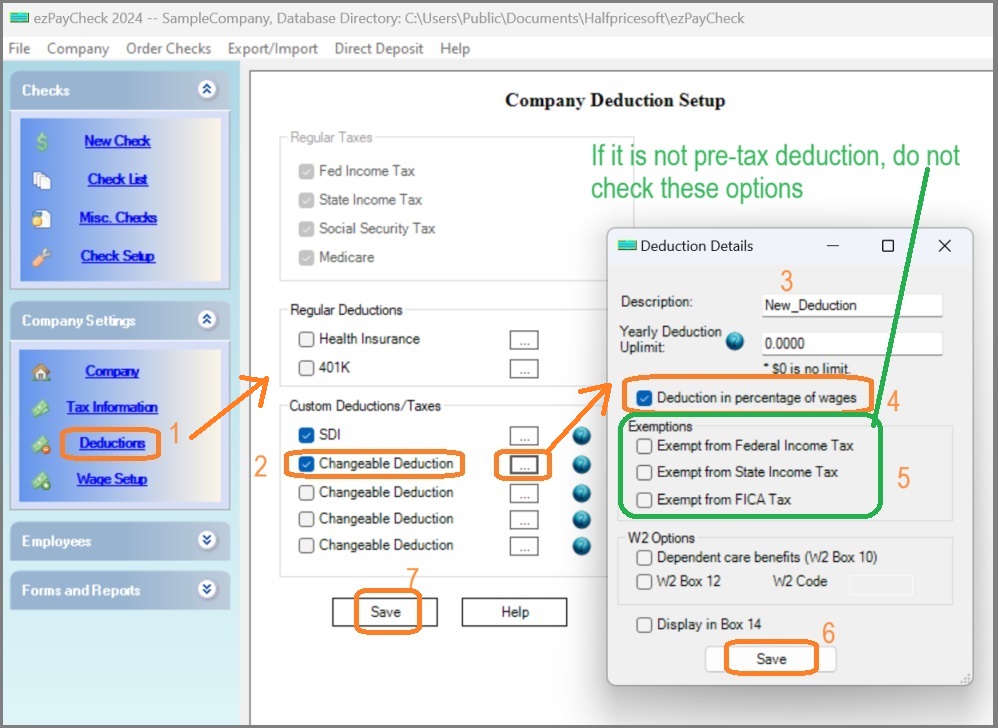

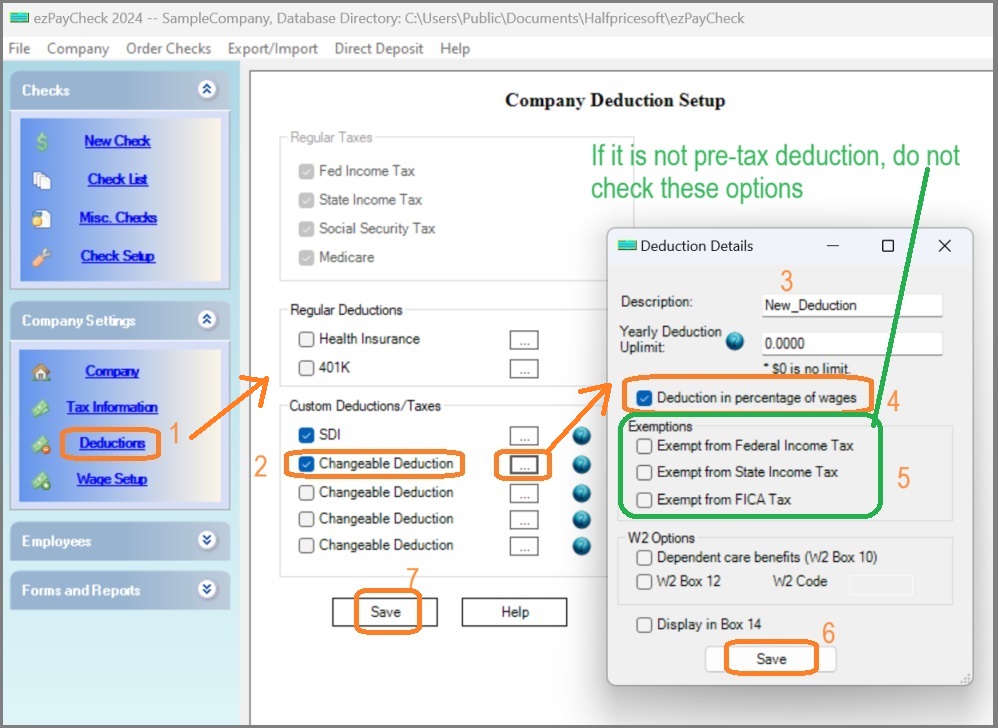

Step 1.1. Add a deduction

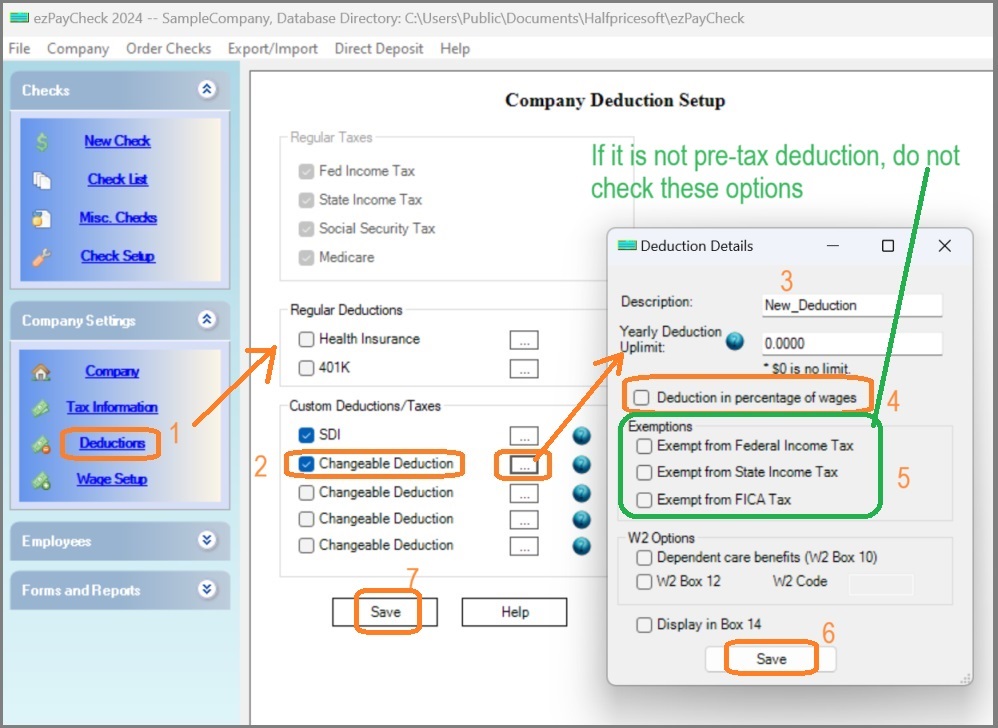

1.1.1. Start ezPaycheck, click the left menu "Company Settings->Deductions" to open the Company Deduction Setup screen.

1.1.2. Check one Customized deduction item, then clicked the button behind it to open the Deduction Details screen.

1.1.3. Input the new name (ie: My_dedution).

1.1.4. Please check the "Deduction in percentage of wage" option box.

1.1.5. Exemptions: if it is a pretax deduction (ie: exempt from FICA tax, fedetal/state tax), you can check exemption option box. Otherwise, leave it unchecked. 1.1.6. Click the "Save" button on Deduction Details screen.

1.1.7. Click the "Save" button on Company Deduction Setup screen to update the database.

1.1.1. Start ezPaycheck, click the left menu "Company Settings->Deductions" to open the Company Deduction Setup screen.

1.1.2. Check one Customized deduction item, then clicked the button behind it to open the Deduction Details screen.

1.1.3. Input the new name (ie: My_dedution).

1.1.4. Please check the "Deduction in percentage of wage" option box.

1.1.5. Exemptions: if it is a pretax deduction (ie: exempt from FICA tax, fedetal/state tax), you can check exemption option box. Otherwise, leave it unchecked. 1.1.6. Click the "Save" button on Deduction Details screen.

1.1.7. Click the "Save" button on Company Deduction Setup screen to update the database.

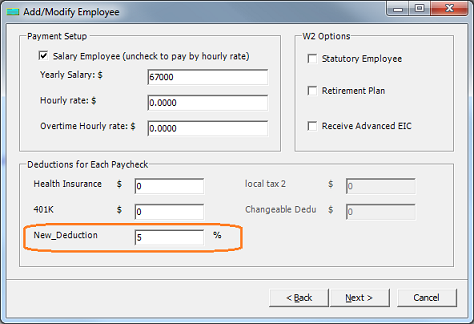

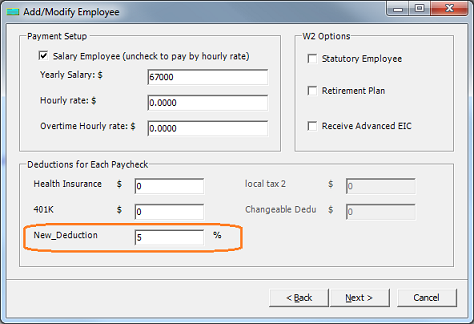

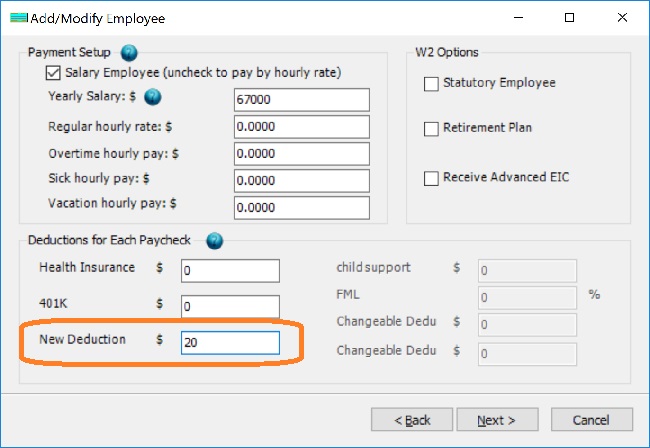

Step 1.2. Edit employee settings to specify the rate/amount of the new deduction

1.2.1. Select one employee from employee list and edited his deduction option.

1.2.2. Enter the percent value.

1.2.3. Click the "Next" button until the last page, then click the "Finish" button to save the change.

1.2.1. Select one employee from employee list and edited his deduction option.

1.2.2. Enter the percent value.

1.2.3. Click the "Next" button until the last page, then click the "Finish" button to save the change.

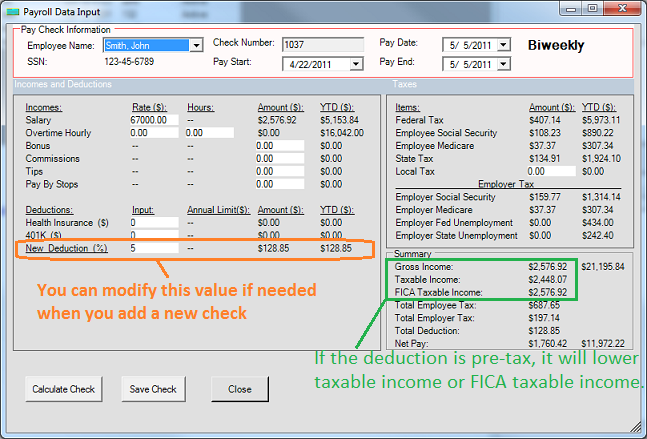

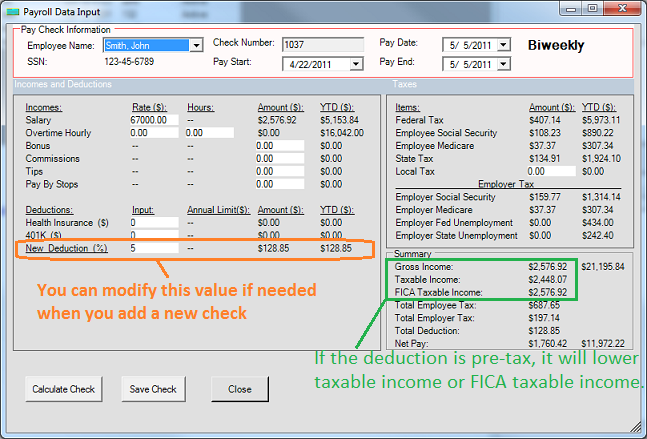

Step 1.3. Generate a new check

- If you added a new pre-tax deduction (because you check the exempt option in step 1.5) , you will see lower taxable income or lower FICA taxable income on screen.

- If it is post-tax deduction, you will see the same values for Gross Payment, Taxable Income and FICA Taxable Income on screen.

Option 2: How to add a by amount deduction

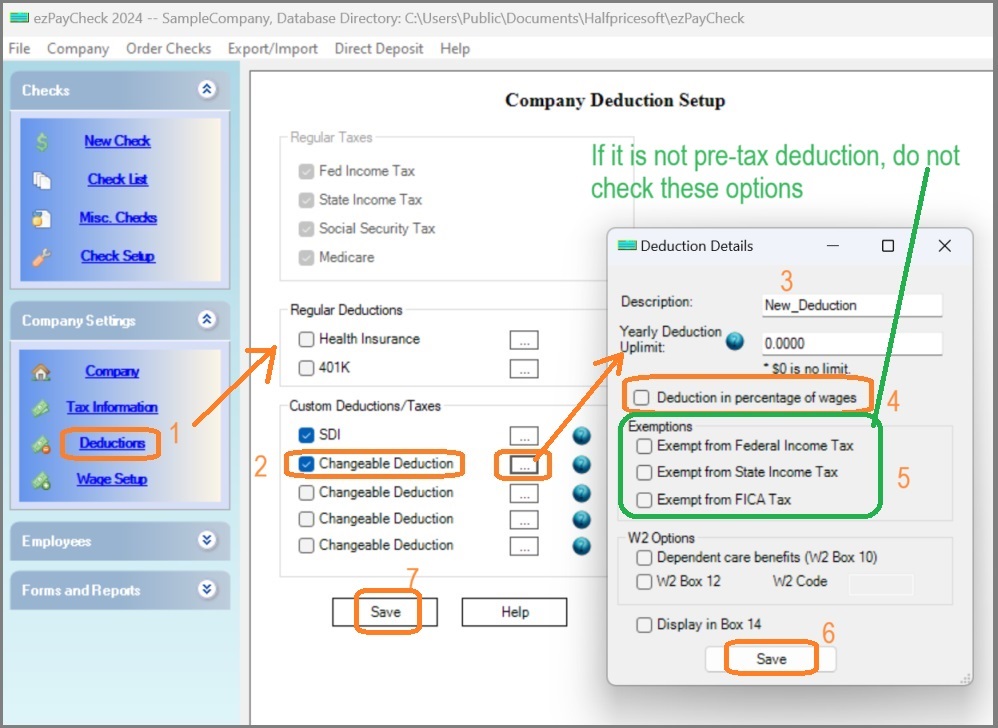

Step 2.1. Add a deduction

2.1.1. Start ezPaycheck, click the left menu "Company Settings->Deductions" to open the Company Deduction Setup screen.

2.1.2. Check one Customized deduction item, then clicked the button behind it to open the Deduction Details screen.

2.1.3. Input the new name (ie: My_dedution).

2.1.4. Please uncheck the "Deduction in percentage of wage" option box.

2.1.5. Exemptions: if it is a pretax deduction (ie: exempt from FICA tax, fedetal/state tax), you can check exemption option box. Otherwise, leave it unchecked. 2.1.6. Click the "Save" button on Deduction Details screen.

2.1.7. Click the "Save" button on Company Deduction Setup screen to update the database.

2.1.1. Start ezPaycheck, click the left menu "Company Settings->Deductions" to open the Company Deduction Setup screen.

2.1.2. Check one Customized deduction item, then clicked the button behind it to open the Deduction Details screen.

2.1.3. Input the new name (ie: My_dedution).

2.1.4. Please uncheck the "Deduction in percentage of wage" option box.

2.1.5. Exemptions: if it is a pretax deduction (ie: exempt from FICA tax, fedetal/state tax), you can check exemption option box. Otherwise, leave it unchecked. 2.1.6. Click the "Save" button on Deduction Details screen.

2.1.7. Click the "Save" button on Company Deduction Setup screen to update the database.

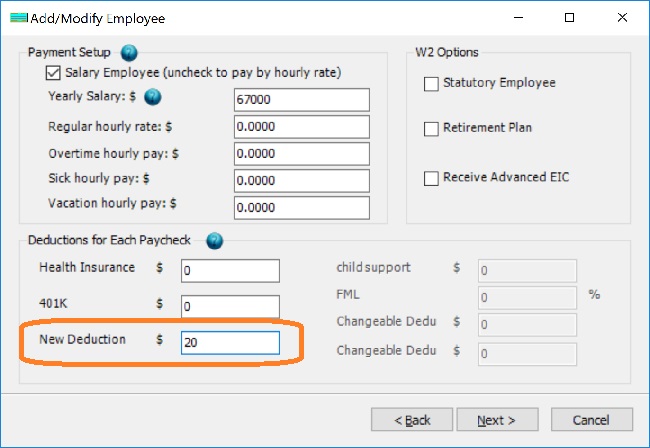

Step 2.2. Edit employee settings to specify the rate/amount of the new deduction

2.2.1. Select one employee from employee list and edited his deduction option.

2.2.2. Enter the amount value.

2.2.3. Click "next" button until the last page, then click the "Finish" button to save the change.

2.2.1. Select one employee from employee list and edited his deduction option.

2.2.2. Enter the amount value.

2.2.3. Click "next" button until the last page, then click the "Finish" button to save the change.

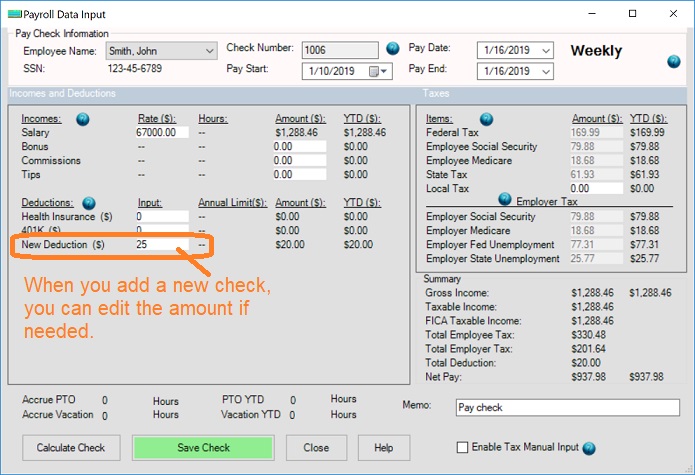

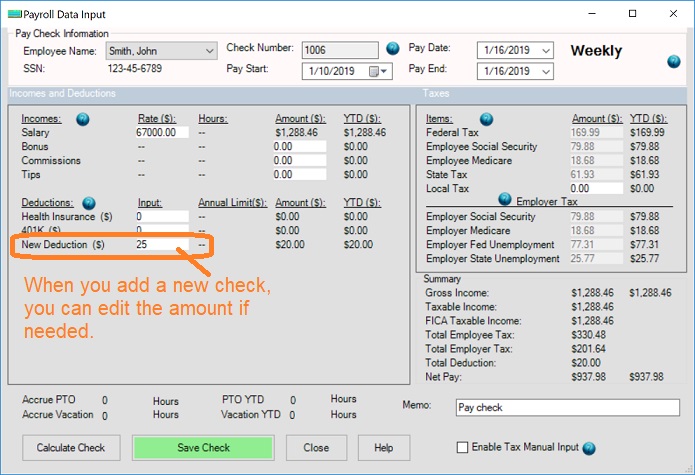

Step 2.3. Generate a new check

- If you added a new pre-tax deduction (because you check the exempt option in step 1.5) , you will see lower taxable income or lower FICA taxable income on screen.

- If it is post-tax deduction, you will see the same values for Gross Payment, Taxable Income and FICA Taxable Income on screen.

Samples

How to handle SDI tax How to handle Oregon transit tax How to handle child support How to set up pre-tax health insurance payroll deduction How to handle occupational tax or professional tax How to handle CO Family Leave Deduction How to handle MA Family Leave Deduction

Troubleshooting

Why the social security tax is not correct Why the federal income tax is not correct Why the state income tax is not correct

(

back to top)

Related Topics