Step-by-Step Guide to Requesting a TCC for E-filing 1099 Forms

A

Transmitter Control Code (TCC) is a unique identifier required by the Internal Revenue Service (IRS) for businesses or individuals who wish to electronically file certain tax forms, including the 1099 series.

If you are a

new user of IRS EFILE service, you need to apply TCC code (Transmitter Control Code) to generate the efile document. You also need to create a FIRE account to upload your file.

1 How to Apply TCC (transmitter control code)

A new online Information Returns (IR) Application for Transmitter Control Code (TCC) is available on the Filing

Information Returns Electronically (FIRE) webpage located at

https://www.irs.gov/e-file-providers/filing-information-returns-electronically-fire.

Steps for New FIRE TCC Applicants

The new IR Application for TCC is available on the FIRE page.

Log into the IR Application for TCC. Validate your identity. If you have an ID.me account from a state government or federal agency, you can sign in without verifying your identity again. If you're a new user, you'll have to create a new ID.me account or use your existing IRS username to access the IR Application for TCC. You will be prompted to create a 5-digit PIN to sign the application if you haven't already done so. Complete the online application. Get the latest information from:

https://www.irs.gov/tax-professionals/about-information-returns-ir-application-for-transmitter-control-code-tcc-for-filing-information-returns-electronically-fire 2 Create a Fire system account

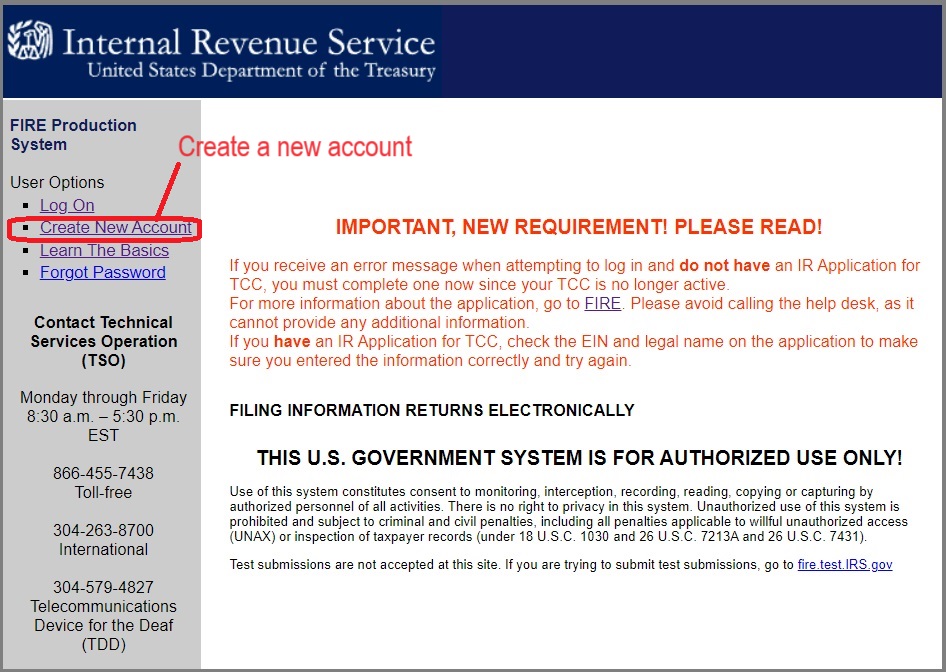

Visit IRS FIRE site https://fire.irs.gov Create a new account Get the latest information from:

https://www.irs.gov/tax-professionals/about-information-returns-ir-application-for-transmitter-control-code-tcc-for-filing-information-returns-electronically-fire

More information:

How to efile 1099 forms to IRS?

Related Links

How can I roll forward my previous ezW2 data to the new version? W2 and 1099 forms filing deadline How to use ezW2 with QuickBooks, PeachTree, ezPaycheck, ezAccounting and other software W2 W3

How to fill out and print Form W2 How to print Form W2 W3 on White Paper How to print multiple copies on the same page for employee How to fill in W-2 data on red forms How to convert W2's into PDF format files How to eFile W2 & W3 Forms How to print Form W3 1099-nec, 1096 (For ezW2 latest version)

How to fill out and print Form 1099-nec How to eFile 1099-nec forms How to print 1099-nec forms on red forms How to convert 1099-nec forms into PDF file How to print Form 1096 W2C, W3c

- Learn more about

W2C and W3C More Forms

- Learn more about

1099s software (1099A, 1099B, 1099C, 1099CAP, 1099DIV, 1099G, 1099H, 1099INT, 1099LTC, 1099MISC, 1099-nec, 1099OID, 1099PATR, 1099Q, 1099R, 1099S, 1099SA)

- Learn more about

1098s software (1098, 1098C, 1098E, 1098 T) software

- Learn more about

5498s(5498, 5498ESA, 5498SA) software

- Learn more about

W2G, 1097BTC, 8935, 3921, 3922 software

- Learn more about

how to file ACA Form 1095 & 1094 to federal and states