SSA Approved. Trusted By Thousands for Over Two Decades.

ezW2 Software: How to Print IRS 1096 Form

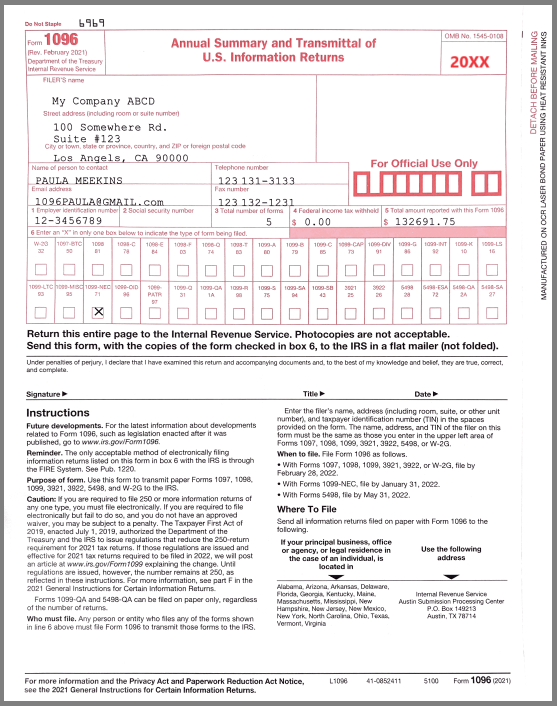

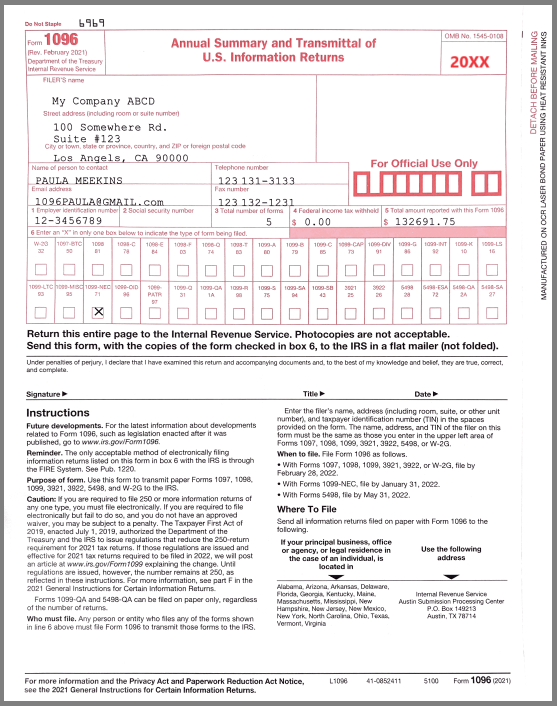

You need to file all 1099-nec Copy A with Form 1096 (Annual Summary and Transmittal of U.S. Information Returns) with the IRS.

ezW2 software can print 1099-NEC forms Copy 1, 2, B, C on white paper. IRS does not certify the substitute forms right now. You need to print 1099-nec copy A and 1096 on the red-ink forms.

Here are the steps:

Step 1: Start ezW2, 1099-nec and W2 software.

1.1 If you have not installed ezW2 software, you can download the trial version for free before purchasing.

1.2 After you installed ezW2 software, you can click desktop shortcut to start ezW2 software easily.

1.3 If you are using the trial version of w2 1099-nec tax form software, you will see the key input pop up screen. You can enter the key code here or click the "TRY DEMO Version" to try this software for free.

(

Note: The trial version will print TRIAL image on forms. You can enter the key code later to remove it.)

Step 2: Set up company information, add contractors and 1099-nec form information

1096 form will be generated automatically based on 1099 form information. If you have not entered your 1099 forms, please follow this guide below.

How to prepare 1099-nec forms

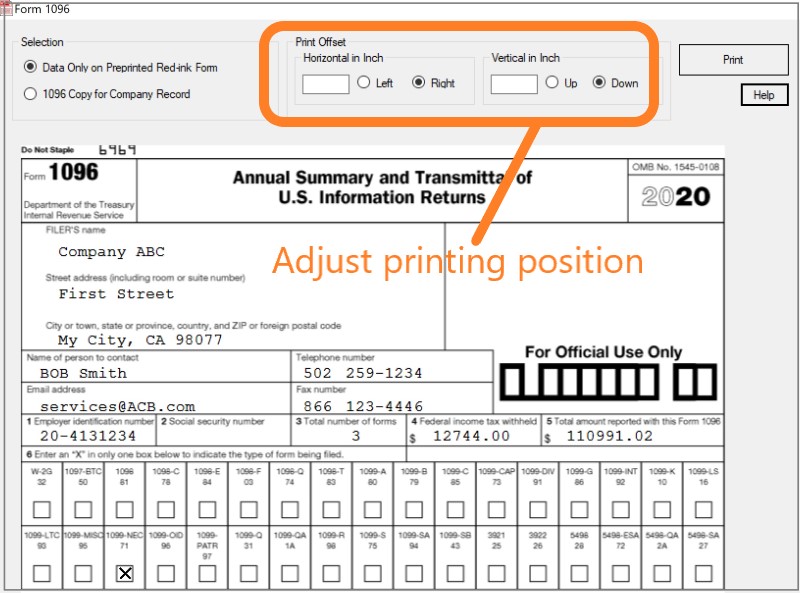

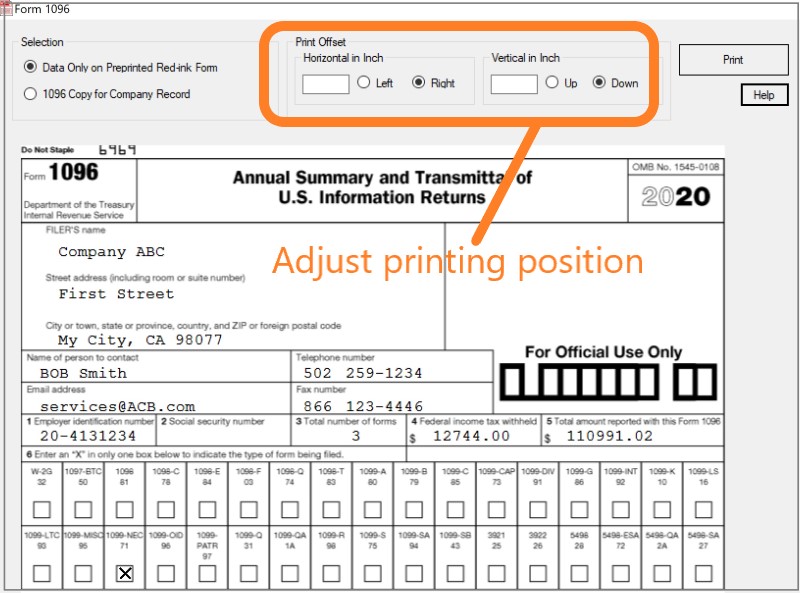

Step 3: Click the top menu "Company->Form 1096" to view 1096 form

If you need to edit the inforamtion on the form, please edit it from company settings and 1096 settings.

| Field Name | How to edit |

Filer's Name:

|

1096 Settings (Click ezW2 top menu "Current Company->1096 Information")

|

|

Company Address

|

Company Settings (Click ezW2 top menu "Current Company->Company")

|

Name of person to contact

Email address

Telephone number

|

1096 Settings (Click ezW2 top menu "Current Company->1096 Information")

|

1. Employer Identification Number

2. Social Security Number

|

Company Settings (Click ezW2 top menu "Current Company->Company")

|

|

3. Total number of Forms

|

Total number of your 1099 contractors (Click the top menu "Current Company->1099 Contractors" to review)

|

4. Federal Income Tax Withheld

5. Total amount reported with this Form 1096

|

Summary information of 1099-nec forms. (Click the top menu "Current Company->1099 form" to review)

|

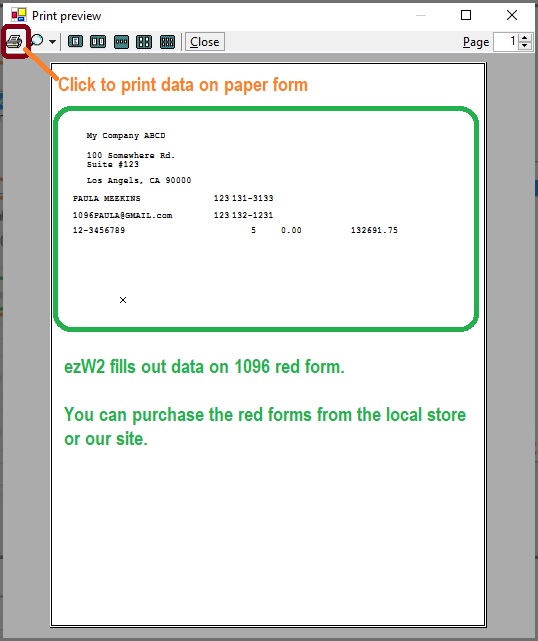

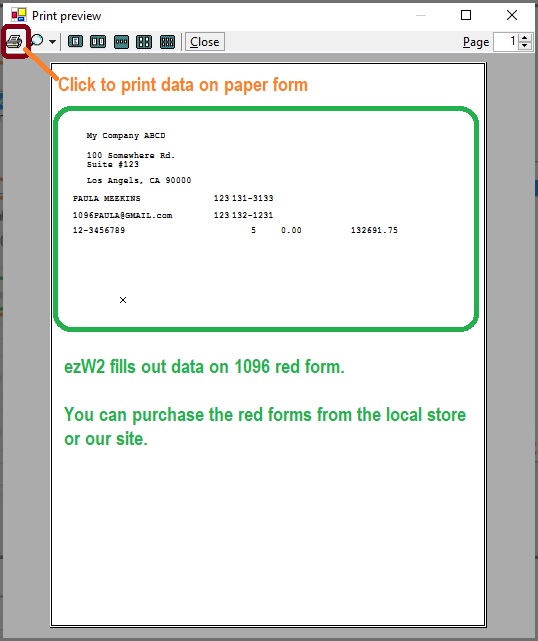

Step 4: Preview and print 1096 data on red form

IRS does not certify the substitute forms. If you will mail the paper forms to IRS, the red forms are required to fill out 1099-nec Copy A and 1096.

Related Links

How can I roll forward my previous ezW2 data to the new version? W2 and 1099 forms filing deadline How to use ezW2 with QuickBooks, PeachTree, ezPaycheck, ezAccounting and other software W2 W3

How to fill out and print Form W2 How to print Form W2 W3 on White Paper How to print multiple copies on the same page for employee How to fill in W-2 data on red forms How to convert W2's into PDF format files How to eFile W2 & W3 Forms How to print Form W3 1099-nec, 1096 (For ezW2 latest version)

How to fill out and print Form 1099-nec How to eFile 1099-nec forms How to print 1099-nec forms on red forms How to convert 1099-nec forms into PDF file How to print Form 1096 W2C, W3c

- Learn more about

W2C and W3C More Forms

- Learn more about

1099s software (1099A, 1099B, 1099C, 1099CAP, 1099DIV, 1099G, 1099H, 1099INT, 1099LTC, 1099MISC, 1099-nec, 1099OID, 1099PATR, 1099Q, 1099R, 1099S, 1099SA)

- Learn more about

1098s software (1098, 1098C, 1098E, 1098 T) software

- Learn more about

5498s(5498, 5498ESA, 5498SA) software

- Learn more about

W2G, 1097BTC, 8935, 3921, 3922 software

- Learn more about

how to file ACA Form 1095 & 1094 to federal and states